There can be little doubt that March 2020 will go down in history. I fear that April 2020 will bring more pain and suffering across this little planet of ours. I have, like I am sure you have also, looked on in horror as events unfolded over the past weeks and felt emotions I never thought possible as I fear for family, friends and communities. We have to hope that medical science will come to assist us with treatments to take some of edge off this insidious pandemic until we can mass produce and distribute a vaccine for COVID19.

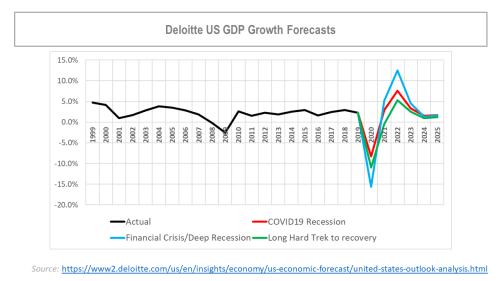

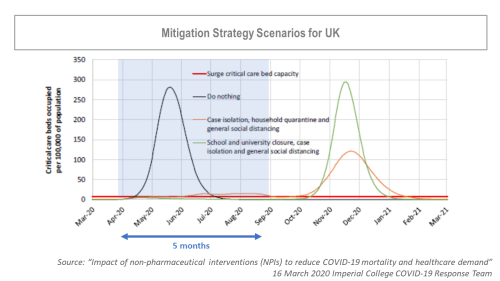

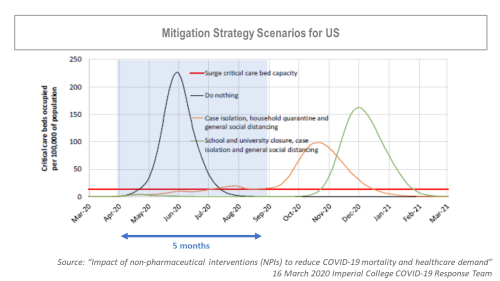

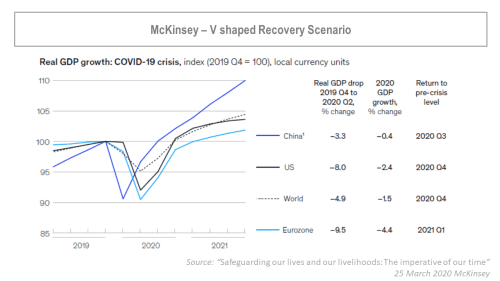

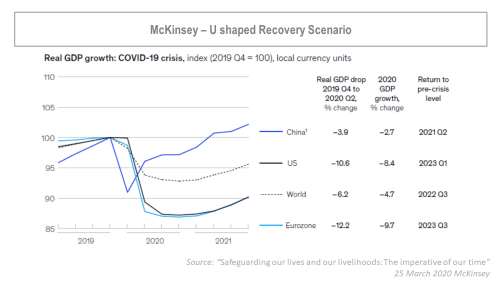

Until recent days, I have not had the stomach to sit down and try to read up on how this nightmare may end. The data, both medical and economical, that will come out in April will likely shock but will hopefully at least help us to figure a route out of this. Right now, I doubt we will ever go back to the world we lived in just a short few weeks ago. The price that will have to be paid for this human tragedy once the virus is conquered will, I fear, include destroyed businesses, unemployment, financial hardship for many and a debt crisis (both corporate & sovereign). If things get really bad, I would fear for social cohesion in the months and years ahead in many communities and countries. So, in trying to start to figure out where we go to now, the exhibits below are those I have taken from some recent reports (as credited) that I thought worth sharing.

Notwithstanding these fears, I do think it’s important to have hope and there are many things happening during this crisis that point to hope. Families getting stronger through adversity and a focus on what is important for us all are just two positives. We’ll see what the coming weeks bring….

Stay Safe.

I put my thoughts below in ROT13. If you are sure you want to read them just go to https://rot13.com/ to decrypt it.

Stay safe!

Va zl bcvavba Fnef-PbI-2 jvyy or jvgu hf sbe 12-18 zbaguf. Fvzcyl orpnhfr vg gnxrf nobhg 12 zbaguf gb grfg n inppvar. Abj nffhzr gung cebqrpherf trg fcrq hc naq fbzr crbcyr ibyhagrre gb grfg orsberunaq naq jr zvtug or n ovg snfgre. Hagvy gura vg vf cebonoyl na ba-bss-fgengrtl nf yvarq bhg va gur Vzcrevny Pbyyrtr cncre ba c. 12 vvep. Gur HX jvyy cebonoyl or uvg ernyyl uneq orpnhfr bs gur cvgvnoyr fgngr bs gur AUF, fb vg zvtug gnxr ybatre gurer. Cebonoyl gur fnzr sbe gur HF.

Nf sbe gur rpbabzl, evtug abj guvf vf gur ovt jnfu-bhg naq jr unir gb znxr fher rabhtu pbzcnavrf fheivir gur fubeg grez naq gung rabhtu pbafhzref unir rabhtu zbarl gb fcraq. Guvf jvyy vapernfr qrog/TQC engvbf orlbaq vzntvangvba naq jr jvyy unir gb qrny jvgu gung nsgrejneqf. Zbfg yvxryl guebhtu fbzr xvaq bs vasyngvba (abg gur nffrg-inevrgl jr bofreirq fb sne, gubhtu), fb lbh zvtug jnag gb ybnq hc ba tbyq naq tbyq zvaref.

Arjf-jvfr guvf vf pheeragyl orvat fcha nf na rpbabzvp pevfvf nsgre gryyvat rirelbar gung gurer vf abguvat gb frr naq jura gurer jnf fbzrguvat gb frr gung guvf vf whfg n syh. Guvf znxrf zr fvpx. Crevbq. Lrf, fbzr crbcyr jvyy ybbfr gurve fuvegf ohg gurl pna ohl arj barf. Orggre guna ybbfvat lbhe yvsr orpnhfr lbhe urnygu flfgrz unf orra fgneirq gb qrngu orpnhfr fbzr fzneg thlf gubhtug guvf vf fgvyy gbb varssvpvrag.

Hi Eddie, hope all is ok with you. Agree on on-off strategy. I follow stats in FT on deaths per pop (just once a day !!) and the UK is tracking Italy, the US looks scary with that moron in charge (he does give me a daily laugh which is something). We’ll see what happens with the economies, I fear it wouldn’t be good (I will buy back into blue chip stocks when S&P500 goes around 2,000), but as you say its all about health. Not looking forward to April!!! Great to hear from you. Stay Safe. M

We are fine, thanks. Surprising how fast a significant part of your work force can work from home when it was a no-no just a couple of months ago…

The UK is somewhat behind the curve, I’m afraid, and the US… well… I wouldn’t want to live there right now. Funny enough that the WSJ proposes to learn from Germany of all countries, namely paying people for staying at home (working part-time basically), to keep the economic machine humming.

Watch out with the S&P at 2,000… this esteemed gentleman forsees a significantly lower fair value of around 1,200 based on historical data:

https://www.hussmanfunds.com/comment/mc200225/

Depends on your choices, of course. Some companies are ahead of the curve like energy or real estate, some are behind like tech. So I guess there will be a nice opportunity set all the time, just with slightly different composition.

All the best,

Eddie