It’s been over 6 months since I last posted on the upcoming merger of Level 3 (LVLT) and Centurylink (CTL). Since then, LVLT’s CEO Jeff Storey has been named COO of the combined entity and CEO from January 2019, after a gentle push from activist investor Keith Meister of Corvex Management (here is an article on their latest position), effectively meaning the merger is an operational LVLT takeover of CTL. In June, CTL also got hit by a lawsuit from an ex-employer alleging a high-pressure sales culture which ripped customers off (an avalanche of class action suits followed). And, potentially more damaging, the recent results of CTL continue to point to deteriorating trends in the legacy part of their business and lackluster growth on the strategic part of the business. CTL missed their quarterly estimates again in the most recent quarter, the third miss in a row.

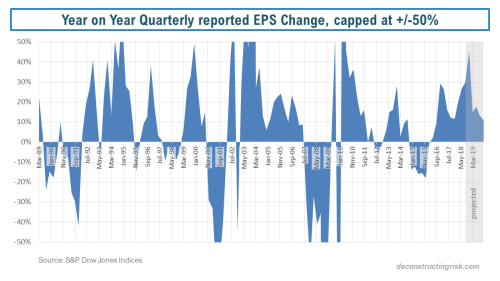

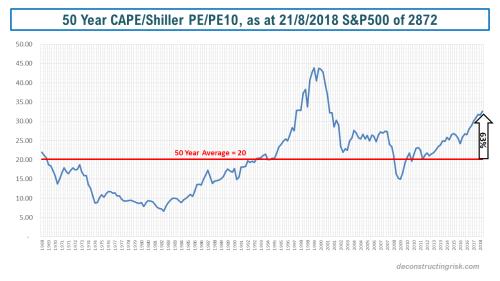

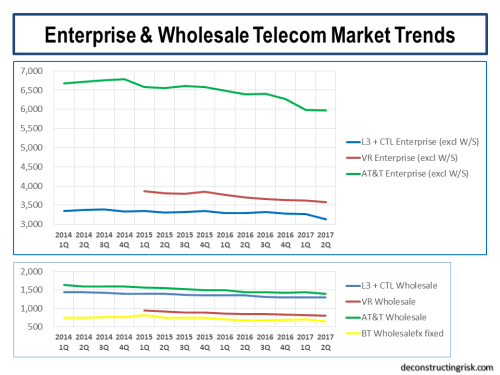

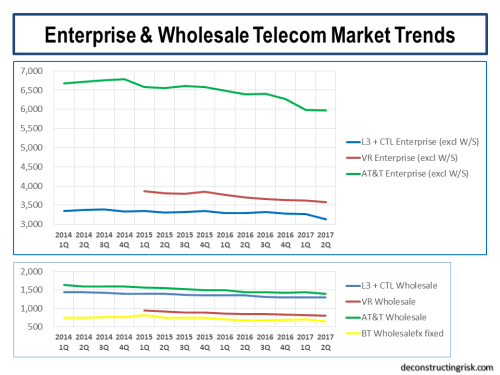

Picking up on my recent telecom industry post, the sector will struggle in the short term to find top line growth before the full impact of new “digital lifestyle” opportunities emerge. The figures below for enterprise, including public sector, and wholesale revenues for some of the biggest US players (which have been adjusted judgmentally for items such as the impact of the XO acquisition on Verizon’s revenues and the ever-changing classifications and reclassifications that telecom’s love) illustrate the current struggle in getting newer IP enabled services to fully compensate for declining legacy revenues.

click to enlarge

These figures imply average quarterly declines since 2014 of -0.3% and -1.2% for enterprise and wholesale business respectively. However, the trend has been getting worse. The average quarterly change was 0.2% and -1.1% for enterprise and wholesale business respectively from 2014 to 2015. Since 2016, the average quarterly change is -0.9% and -1.3% for enterprise and wholesale respectively. Not exactly a cheery trend when contemplating the prospects of a merged CTL/LVLT!

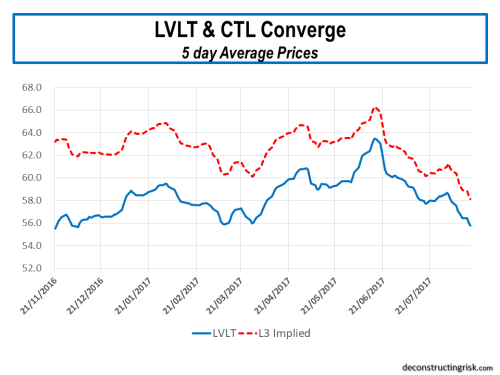

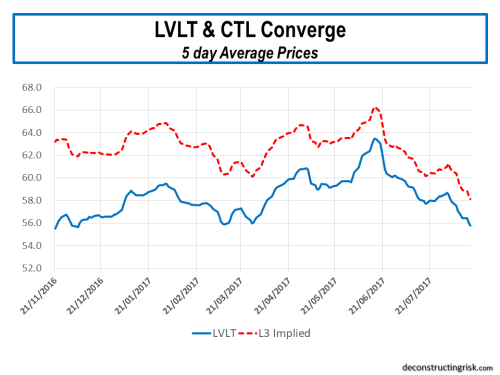

As can be seen below, the share price of LVLT and deal implied price have converged, particularly as CTL’s dividends get paid, albeit with a sharply downward bias in recent weeks over worries about dividend sustainability, valuation, sector trends, lawsuits and uncertainty over the closing date of the merger (a delay by California, the last State approval needed, may mean the end of September deadline is missed).

click to enlarge

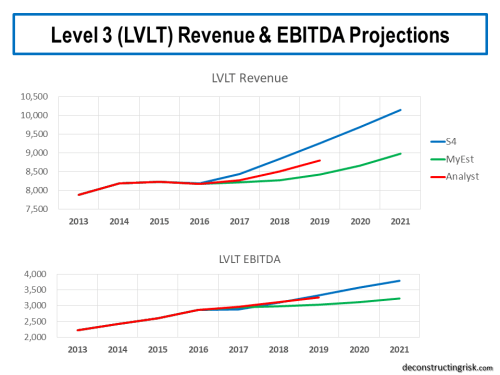

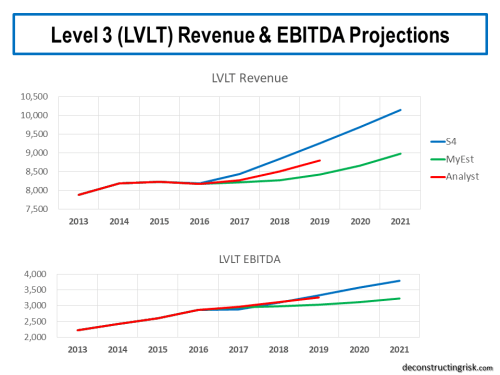

My estimates for a standalone LVLT compared to analyst figures and those presented by LVLT management in the S4 (figures presented for merger negotiations are generally on the optimistic side) are below. Even factoring in higher interest rates (about 40% of LVLT’s debt is floating) over the coming years, I am comfortable with a standalone share price around the current mid-50’s, in the unlikely event the merger falls apart.

click to enlarge

To recap on my confidence in the ability of LVLT’s current management team to deliver, the results of the last merger between LVLT and TWTC show that management delivered a 40% uplift in the amount of free cashflow (e.g. EBITDA less capex) on flat revenues from 2014 to 2017 (e.g. combined FCF of both entities in the year prior to the merger to actual H1 results and my estimates for H2 2017). Some of my many previous posts on LVLT are here, here and here. Such a repeat in FCF in the CLT/LVLT merger is not a realistic expectation given the larger scale and different business mix, as the analysis below illustrates. Of course, the flat revenues over the past 3 years is a key concern (but worthy of praise given the industry trends highlighted above) and one of the catalysts for the CLT deal. Also, the health of designate CEO Jeff Storey may also be a factor over the next few years given his heart issues a few year ago.

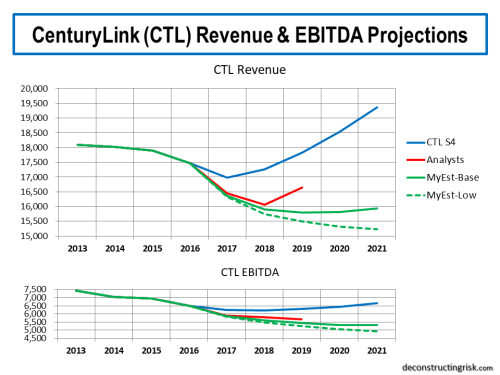

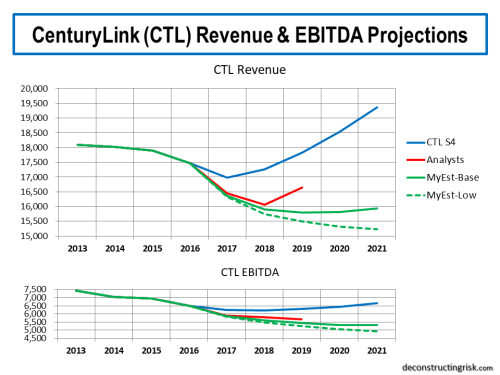

My knowledge of CTL’s business is not as deep as that of LVLT’s and my confidence in their prospects on a standalone basis is nowhere near as lofty. My projections, split over a conservative base scenario and a more conservative low business scenario, can be seen below. My projections are primarily based upon the more recent trends in their business lines across their legacy and strategic enterprise and consumer businesses. The vast variance in my estimates, based upon recent trends, and those presented by management in the S4 (again, acknowledging that these are generally optimistic) illustrates why the market has lost such confidence in the outgoing management team at CTL, in my opinion.

click to enlarge

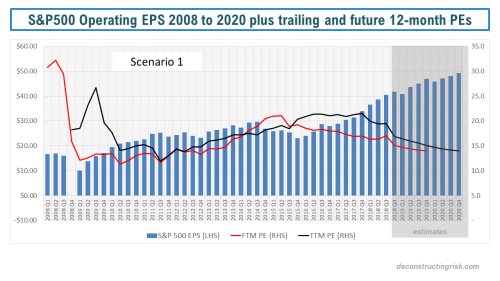

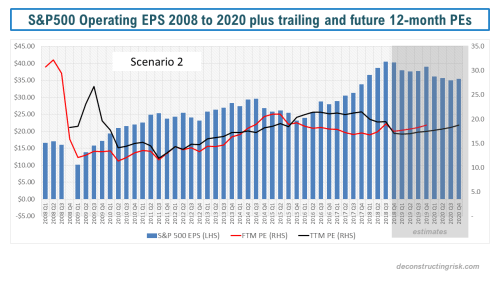

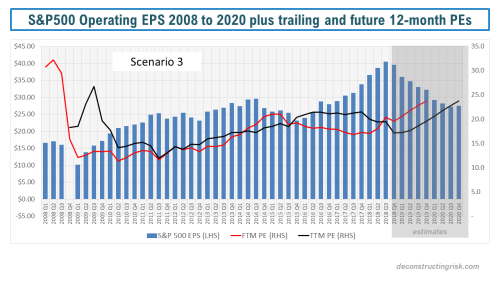

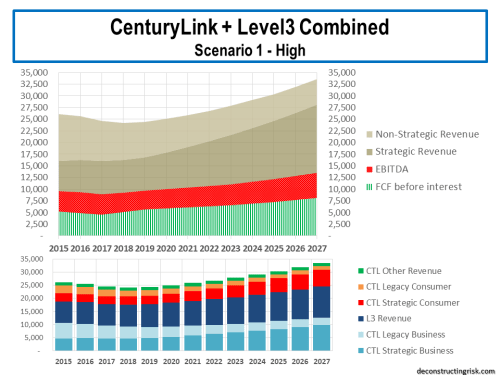

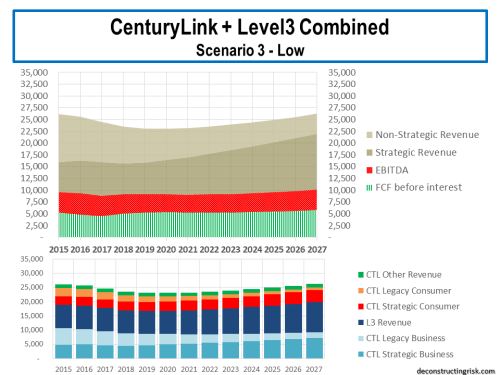

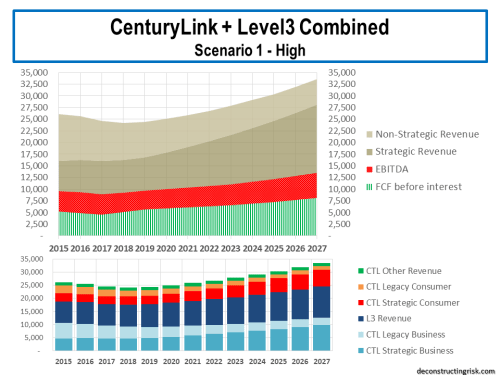

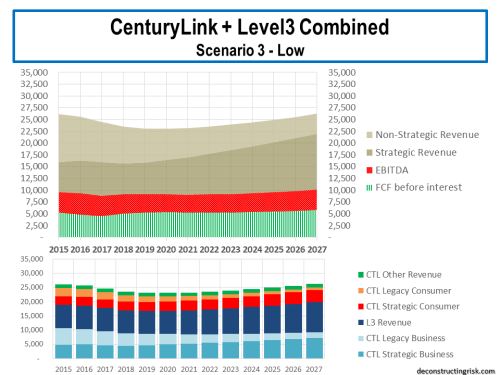

In terms of trying to model the merged CTL/LVLT, I have assumed the deal closes by the end of 2017 with 2018 being the first year of the merged entity. I have made a number of judgmental adjustments in my model, including assuming some loss of revenue due to the merger and cost reductions above published target synergies (e.g. $1 billion of operating synergies by end 2020 and $150 million of capex synergies by end 2019, higher than the announced target savings of $850 million and $125 million for opex and capex respectively). I have taken analyst estimates as an optimistic case (in CTL’s case I have taken their EBITDA estimates but still can’t get anywhere near their revenue figures) and called it the high scenario. My two projections above are used for the base and low scenarios. The resulting operating metrics for each scenario is shown below.

click to enlarge

The high scenario shows revenues flat-lining slightly above $24 billion for 2018 and 2019 with top-line growth returning in 2020 (YoY above 2.5%). EBITDA margins hit 40% by 2019 and remain stable around 40% thereafter. Capex is assumed to hit 15.5% of revenues by 2019 and remain at that percentage thereafter. This scenario assumes that management will be able to generate an approximate 30% uplift in the amount of free cashflow (e.g. EBITDA less capex) from 2017 (e.g. combined FCF of both entities in the year prior to the merger) to FY 2020.

click to enlarge

The base scenario shows revenues flat-lining around $23.5 billion for 2018 through 2020 with top-line growth returning in 2021 (YoY just below 2%). EBITDA margins hit 40% by 2019 and slowly trend down toward 39% thereafter. Capex is again assumed to hit 15.5% of revenues by 2019 and remain at that percentage thereafter. This scenario assumes that management will be able to generate an approximate 22% uplift in the amount of free cashflow (e.g. EBITDA less capex) from 2017 (e.g. combined FCF of both entities in the year prior to the merger) to FY 2020.

click to enlarge

The low scenario shows revenues around $23.5 billion for 2018 and drifting down to $23 billion before slowly hitting $23.5 billion again by 2022. Thereafter revenue growth builds slowly from 1.5% to 2.5% by 2027. EBITDA margins hit 39.5% by 2019 and slowly trend down toward 38.5% thereafter. Capex is again assumed to hit 15.5% of revenues by 2019 and remain at that percentage thereafter. This scenario assumes that management will be able to generate an approximate 18% uplift in the amount of free cashflow (e.g. EBITDA less capex) from 2017 (e.g. combined FCF of both entities in the year prior to the merger) to FY 2020.

I also assume the merged entity will carry $38 billion of debt from the offset (resulting from merger expenses, the cash payout to LVLT shareholders, and existing debts from both firms, after factoring any proceeds from recent CTL divestitures). I estimate that only 30% of this debt load is subject to a floating rate. In all scenarios, I assume the LIBOR rate linked to the floating rate increases incrementally by 275 basis points over the next 3 years (the current 12 month US rate is about 175 basis points). With a net debt to EBITDA ratio of approximately 3.8 at the end of 2018 across all scenarios, I believe that getting that ratio below 3 within 4 years by 2021, at the latest, will be a primary objective of the new management team. That would only be prudent in my view given the likely tightening monetary environment over the next few years which will punish valuations of corporates with high debt levels. Also, management will want to remain flexible if higher capex is needed to compete in new technologies for the IoT and digital lifestyle era (see recent sector post). I haven’t factored in an upside from LVLT’s CFO Sunit Patel proven ability to actively manage debt rates and maturities (his ability is highlighted by the fact that LVLT’s fixed debt costs 5.5% compared to CTL’s admittingly much larger fixed debt costing 6.8%)

That leads to the thorny question of the sustainability of the annual dividend of $2.16 per share (particularly given that share count will double, amounting to $2.3 billion per year). Under the high scenario, maintaining the current dividend and getting the net debt multiple below 3 by 2021 is doable if a little tight (primarily due to the cashflow benefits of LVLT’s NOLs). For both of the base and low scenarios maintaining the current dividend level is not realistic in my view, with a cut in the dividend to $1.30 and $1.00 needed in each scenario respectively (a 40% and a 55% cut). The current dividend yield on CTL is over 10%. Each of the cuts above would reduce that yield to approximately 6% and 5% for the base and low scenarios respectively based upon the current share price. Addressing the uncertainty over the dividend should be one of the priorities of the new management (and may even result in Jeff Storey’s move to the CEO position ahead of the planned January 2019 date).

Finally, before I reveal my per share valuations, I haven’t given any consideration to the financial impact of the current legal cases on alleged aggressive sales tactics as the level of current detail makes any such estimate impossible. Some of the class action cases claim anything from $600 million to $12 billion but these claims are always bloated and the eventual settlement figure, if there even is one, are often for a lot less than that claimed. Nor have I considered the potential impact of a spin-off of the consumer business (that’s for another time!).

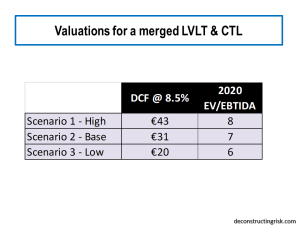

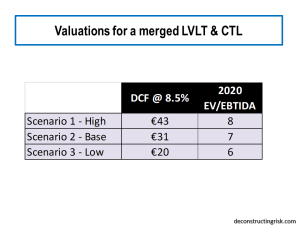

So, based upon the analysis outlined in this post and using a discount rate of 8.5%, my valuation estimates for each of the three scenarios are below.

click to enlarge

The market’s current valuation of CTL around $20 indicates scenario 3 as the current expectation. This emphasizes the need to address the uncertainty over future dividend levels and the validity of the legal cases. Uncertainty over the closing date of the deal is overblown, in my view, and a few months of delay will not prove material. I do think the current valuation is harsh, given the potential upsides from the deal and longer-term industry trends. Interestingly, my base scenario valuation of £31 is not too far off the value of $34.75 by BofA Merrill Lynch and Morgan Stanley in the S4 (see this post on the S4). The base scenario is the one I would have the most confidence in, based upon my current knowledge, rather than the high scenario of $43 which does look too optimistic to me given current market trends.

I was never going to reinvest the cash component of the deal for LVLT shareholders given my current reservations about market valuations and move to cash across my portfolio. The analysis presented in this post indicates to me that the CTL shares due from the deal for LVLT shareholders are worth holding from a valuation perspective. For now.

For new investors, I’d wait to see how some of the uncertainties play out, particularly the dividend issue.