Since I last posted on the gambling sector in March, the bad news just keeps on coming for the sector. The one bright spot has been the opening of the US market although, as my last post highlighted, the US business is on the lower end of the margin spectrum and there is considerable investment needed as the market opens. William Hill (WMH.L), GVC (GVC.L) and Paddy Power Betfair (PPB.L) are down 50%, 30% and 15% since my March post.

Some of the issues hitting the sector include the UK reduction in stake limits to £2 on gaming machines, the UK increasing the rate of remote gaming duty from 15% to 21% in 2019, new point of consumption taxes and restrictions on advertising in Australia, and increases in betting taxes in Ireland. Compounding these issues is a fiercely competitive environment with operators such as the privately owned Bet365 being very aggressive in sectors such as horse racing.

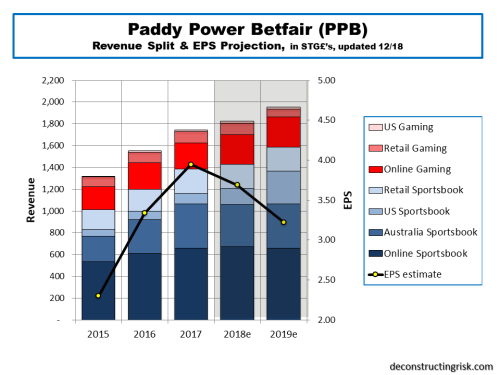

To illustrate the impact on PPB, my estimates below show a declining EPS for 2019 (the firm estimated all the changes impacting EBITDA by £115 million against their 2018 EBITDA midpoint estimate of £472 million, that’s a 24% hit!). My 2018 and 2019 EPS estimates are now down from £4.36 and £4.51 to £3.70 and £3.25 respectively. That’s an approx 15% and 30% cut for 2018 and 2019 respectively.

At the closing price today of £63.85, my 2019 EPS estimate implies a PE multiple of 20, way too scarily high given the headwinds in this sector and the overall market direction. The US represents the one bright spot in terms of top-line growth although I would be skeptical about the US business having a major bottom line benefit for a few years yet.

I did say previously that his sector is haunted by regulatory risk, haunted to the point of being scared to death!