If you exclude investing, I am not a gambler. However I do find the gambling sector fascinating. I have been posting on the sector for over four years now (see posts under Gambling Sector category). As an example of an old bricks and mortar sector that has been revolutionised in recent years by the internet and smart phones, it is illuminating. As I said in a previous post, “this sector is haunted by regulatory risk” and this post will run through some regulatory developments, as well as business ones.

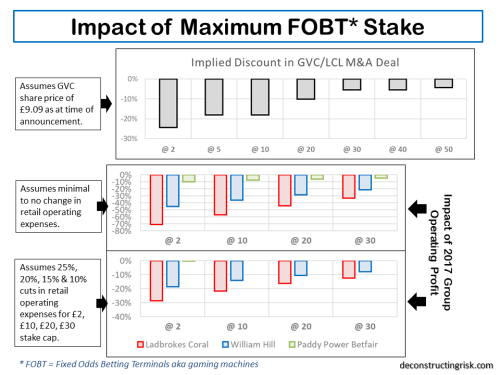

Late in December last year, Ladbrokes Coral (LCL) agreed to a takeover deal by GVC, the Isle of Man consolidator who owns BWIN, Sportbet, PartyPoker and Foxy Bingo. The smaller GVC, with 2017 revenue of €0.9 billion, structured an innovative deal for the larger LCL, with 2017 revenue of approx. £2.4 billion (I will update these figures when LCL announces its final 2017 figures in the coming days), with a sliding scale valuation based upon the UK Government’s triennial review of the sector.

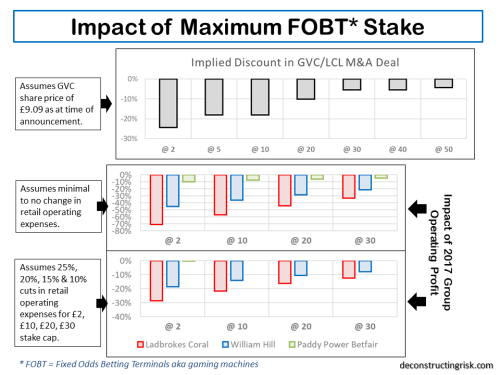

The UK regulator and the government’s adviser on the issue, the Gambling Commission, today released its advice on fixed-odds betting terminals (FOBTs), often described as the “crack cocaine” of gambling. The Gambling Commission recommended a limit of £2 for “slot” style games, called B2 slots, and “a stake limit at or below £30” for other non-slot B2 games, such as the popular roulette games. Although LCL and William Hill shares popped today, the final decision is a political one and its by no means certain that a limit lower than £30 will not be implemented.

Based upon the sliding scale in the LCL/GVC deal and some assumptions on retail operating cost cuts based upon different FOBT stake limits, the graphic below shows the potential impact upon the business of LCL, William Hill (WMH) and Paddy Power Betfair (PPB). Again, LCL is based upon H1 results extrapolated and will be updated for the final 2017 figures.

click to enlarge

Based upon very rough estimates, the limits recommended could result in around 400 to 700 betting shops disposals or closures by the bigger firms, albeit that these shops are likely to be the least attractive for rivals or smaller firms. These estimates do not take into account potential mitigating actions undertaken by the betting firms. Lost FOBT revenue could be made up by increased sports betting facilitated by the introduction of self-service betting terminals (SSBTs) which allow punters to gamble on new betting products.

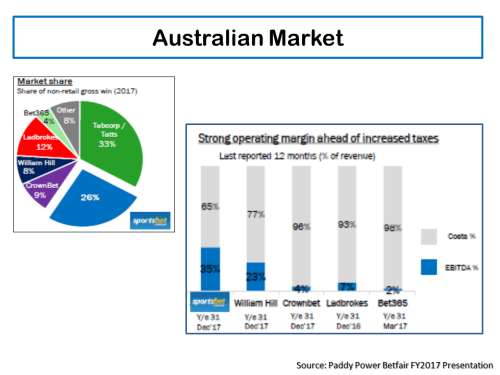

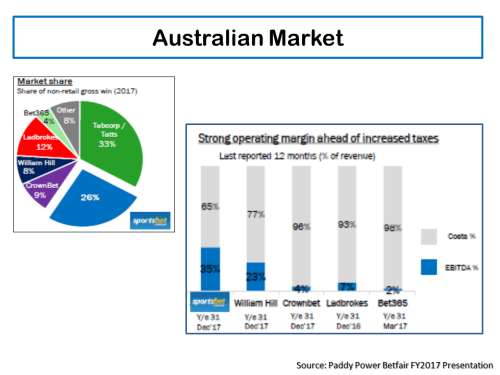

Point of consumption (PoC) taxes have been introduced in countries such as the UK and Ireland in recent years and are now payable in South Australia and have been announced in Western Australia. The other states in Australia are likely to introduce PoC taxes in 2019. These developments caused WMH to take a write-down on its Australian operations and sell them in March to the Canadian poker firm the Stars Group (formally the colourful Amaya), owner of PokerStars, PokerStars Casino, BetStars, and Full Tilt. The Stars Group (TSG) also increased its ownership in the Australian operator Crownbet in March which it intends to merge with the William Hill Australian operation. PPB was reported to have been interested in Crownbet previously but was obviously beaten on price by TSG. PPB had the exhibit below in their 2017 results presentation on the non-retail Australian market.

click to enlarge

A more positive regulatory development in the coming months could be a favourable decision by the US Supreme Court on the future of the Professional and Amateur Sports Protection Act of 1992 (PASPA). This whitepaper from the Massachusetts Gaming Commission gives a good insight into the legal issues under consideration and the implications for the sector in the US of different Supreme Court decisions, such as upholding PASPA or a narrow ruling or a full PASPA strike down. Other issues in the US include the terms under which individual States legislate for betting. The consultants Eilers & Krejcik opine that “a market incorporating both land-based and online sports betting products could be worth over two times a market that is restricted to land-based sports betting alone” although they conclude that “many – perhaps even most – states will choose to delay or forgo online”. It may be likely that many States will follow Nevada’s example and require online accounts to be initiated by a land-based provider with age and ID verification conducted on premises.

Sports betting in the US is generally low margin with WMH reporting US gross win margins around 6%. Other tailwinds to the US sector include rent seeking participants such as the sports bodies looking for “integrity fees”, a figure of 1% on the amount staked (called the handle in the US) have been suggested, or aggressive tax policies and levels by individual States. This paper by Michelle Minton outlines some fascinating background on PASPA and argues that any legalisation of betting across the US must be pitched at a level to counter the illegal market, estimated at $120 billion per year to be 20 times the size of the current legal sector in the US.

Philip Bowcock, the CEO of William Hill, in the 2017 results call summarised the opportunity in the US as follows:

“We do not quite know how the economics will work out because, as I said, there are three ways this could potentially go. It could either go purely retail, only taking sports bets in a retail environment. It could be the Nevada model, which is retail plus a mobile app signed up for in the retail environment. Or it could go completely remote registration, which is as we have in the UK. I do not expect every state in the US to regulate, and if they do, to go for that end model. I think each one is going to be different, and that is going to decide where we are as to what the economics are going to be.”

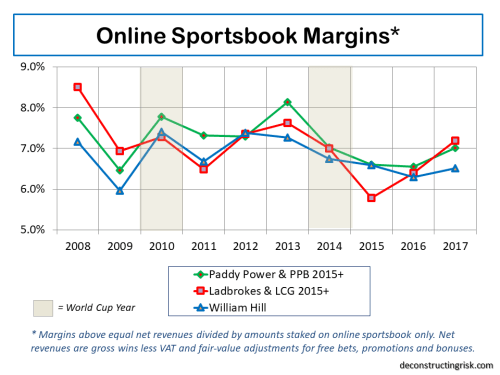

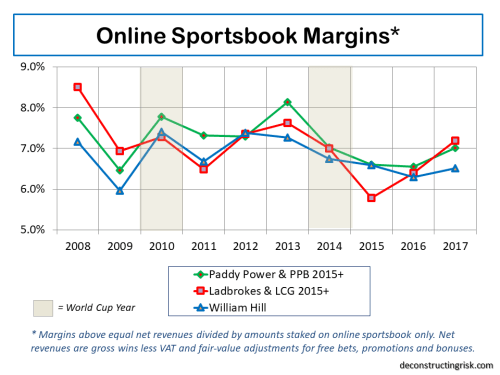

So, they are some of the regulatory issues challenging the sector today. In terms of historical and 2017 sportsbook margins shown below, I have spend some time revisiting my data and extracting more accurate data, particularly in relation to historical Ladbroke sportsbook net revenue margins. H2 sportsbook results, particularly Q4 results, were very favourable for the bookies. I estimate that the Q4 figures for PPB improved their full year net revenue margin on its sportsbook by 120 basis points. I debated whether to adjust the 2017 figures for the Q4 results but decided against it as the results reflect the volatility of the business and good or bad results should be left alone. It is the gambling business after all!!! As above, the LCL numbers are those extrapolated from H1 results with an uplift for the H2 favourable results and will be updated when the actual results are available.

click to enlarge

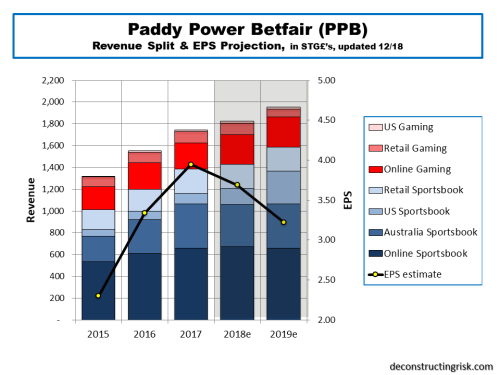

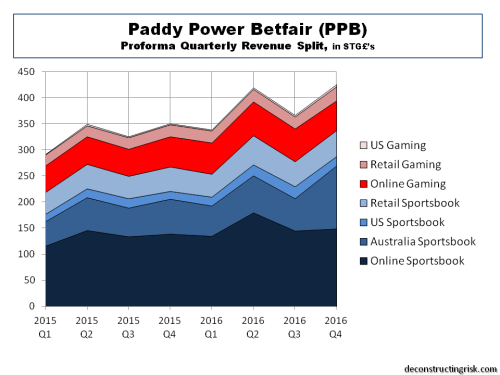

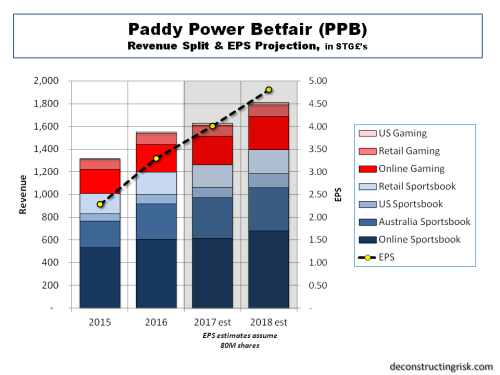

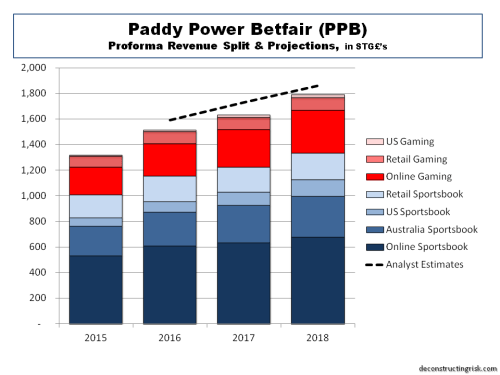

On the specific results from PPB, their 2017 EPS came in at £3.98, ahead of my August estimate of £3.72 for 2017 (see post here) but still behind my more optimistic March estimate of £4.14 (see post here). The lacklustre online sportsbook results are a concern (revenues up 8% compared to 14% and 25% for WMH and LCL respectively), as are the declining online gaming revenues. Increases in PoC taxes in Australia will impact operating margins in 2019 and FX will be a tailwind in 2018. Increased IT resources and investments in promoting new products and the Paddy Power brand are the focus of management in 2018, ahead of the World Cup. Discipline on M&A, as demonstrated by walking away from a CrownBet deal, are also highlighted as is potential firepower of £1.2 billion for opportunistic deals.

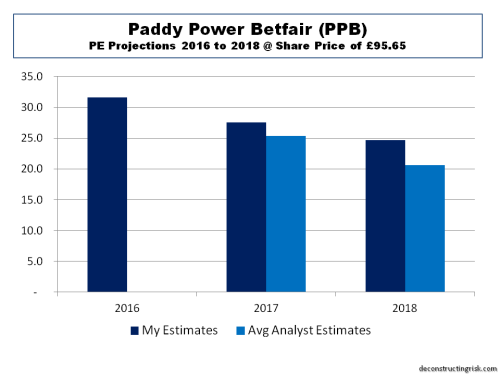

My new estimates for 2018 & 2019, after factoring in the items above, are £4.36 and £4.51 respectively, as below. These represent earnings multiples around 17 for PPB, not quite as rich as in the past, but justified given the 2017 results and the headwinds ahead. PPB must now show that it can deliver in 2018, a World Cup year, to maintain this diminished but still premium valuation.

click to enlarge

The coming months in this sector will be interesting. The fate of firms such as 888, with a market cap around £1 billion, will likely be in the mix (interesting that its fits within PPB’s budget!). WMH and 888 have tangoed in the past to no avail. Further dances are highly likely by the players in this fascinating sector.