Even before the COVID19 outbreak, it was a time of rapid change and transformation in the sports betting and online gaming sector. Since my last post nearly a year ago, the big news was the merger of Flutter (FLTR.L) and the Stars Group Inc. (TSG) in an all stock deal (at a 55%:45% split). The deal was announced in October and closed in May. The headwinds in the sector include an increased regulatory focus, particularly on problem gambling, and an array of new taxes and restrictions which have pushed the sector further along the consolidation route. The great hope for the sector was the opening of online gambling and gaming in the US.

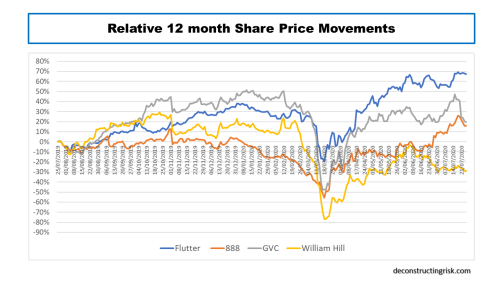

With that as the background, the COVID19 pandemic initially looked like it could create serious issues for the sector with cancelled sports events and retail shop closures. As the virus developed however, the upside in the demand for online gaming and gambling from people stuck at home combined with the spending power of government checks has resulted in a surge of online activity, particularly in gaming. The graph below of the relative share price movements over the past year for a sample of the market players illustrates the renewed optimism with the recent announcements on heightened online activity.

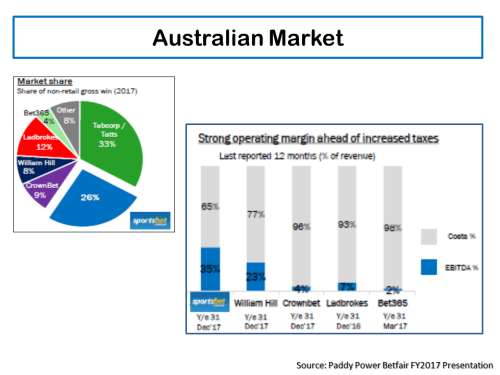

The performance of William Hill, with its over-reliance on retail, shows how far that business model must adapt to regain some of its former glory. 888, always the bridesmaid in the M&A dance of recent years, announced in June a 34% increase in average daily revenue in the year to date and boasted that it expected to beat EBITDA estimates for 2020 by a significant amount. In July, GVC announced a 30% H1 increase in online gaming and a 5% increase in online sports. For Q1, Flutter, which has been the focus of my posts in the past, initially announced approx. 30% growth in quarterly revenues up until the 15th of March with a dramatic fall off thereafter. In May, Flutter announced results to the 17th of May which showed extraordinarily strong gaming results and strong US and Australian performance. In late August, we will get a chance to see the H1 results of the newly merged entity in all its hoped for glory.

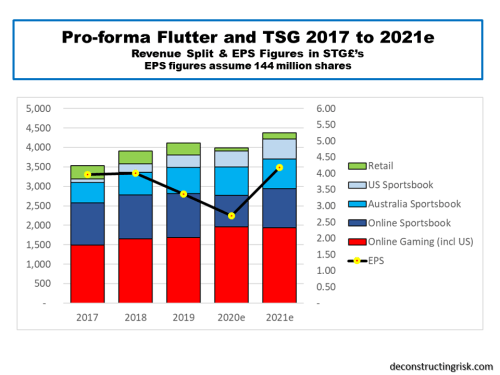

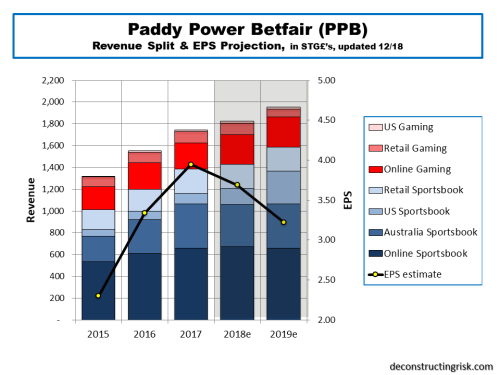

Projecting the short term in this pandemic environment is fraught with danger. Uncertainties relating to how the health situation develops, whether there will be more shut-downs or more openings, a second spike, whether government wage supports will be tempered, how defaults will progress are all subjects of daily discussion across the media. Notwithstanding these uncertainties, I have attempted to do a very rough and ready projection for the newly merged Flutter entity with the overarching assumption that gaming will remain strong, but not as extraordinary as the partial May figures, for the rest of 2020 (as will the US and Australia) but will pull back in 2021 as economies open back up and the full force of the recession and the COVID19 bills become reality. Offsetting the pull-back in 2021 of gaming is the opening of retail (albeit at a lower level than pre-COIVD) and the return of sports betting to a more normal level. The US is projected to continue its march forward in 2021. For my projections, the international and UK business of TSG is allocated to the online gaming and online sports lines as per the historical TSG breakdowns. The Australian business of Flutter and TSG is shown together.

I would again emphasize that my figures are rough guesstimates, particularly the operating results. Although the presentation released at the time of the merger announcement used 2018 figures, I looked through the updated prospectus from March which used 2019 figures and made my COVID adjustments for 2020 based upon trends to date and assumed impacts upon margins. For example, the merger presentation touted EBITDA margins of 30% and above for the future whereas I have assumed the 30% EBITDA margin in 2018 for the combined entity falls to 27%, 25% and 28% for 2019 to 2021 respectively.

The big difference in the business model of the newly merged entity is the amount of debt it is carrying now. I have assumed net debt of £3.85 billion at the end of H1 2020 and a pro-forma net debt to EBITDA multiple of 3.86 and 3.12 for 2020 and 2021 respectively (assuming no debt repayments over that time, the amount of which will depend upon whether they restart dividends). Their stated target to get below 2 quickly (e.g. by end 2022 or 2023 at the latest) looks very achievable given the highly cash generative nature of this business.

My proforma EPS estimates, based upon 144 million shares, is £2.70 and £4.19 for 2020 and 2021 respectively. The 2020 figure is marginally below their stated 150% uplift of the pre-merger 2019 EPS but not materially so given the COVID impact. On a forward PE basis, the stock currently trades at a 27.5 multiple of the 2021 EPS which is not out of line with the current market sentiment. Better growth than I have assumed for the remainder of 2020 and into 2021, the potential for the US business, and future synergies from the merger could justify such a premium rating. For me, cautious as ever and soooo remarkable bad at market timing, I would need to see more on the 2020 trends and a pull-back to be tempted out of my bear pit. I’ll leave it up to you, dear reader, to make your own mind up.

UPDATED H1 NUMBERS

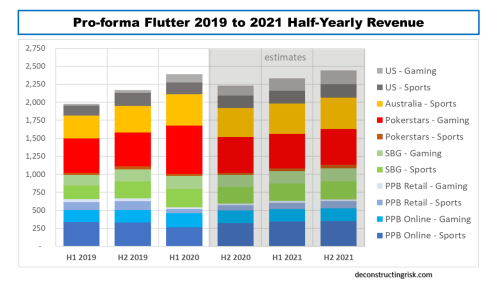

On the 27 August, Flutter released their H1 figures and gave further insight into how 2020 may develop. I did highlight that my figures above were rough guesstimates and the actual H1 numbers showed that I got a few items wrong. First off, I missed the impact of the May 2020 equity raise which means net debt as at the end of H1 was £2.9 billion rather than the £3.85 billion I estimated. Also, share count at the end of H1 was 157 million rather than the 144 million as a result of the equity raise. Secondly, the H1 proforma revenue came in at £2.4 billion, making my FY2020 revenue estimate of £4 billion look light (ditto for 2020 earnings).

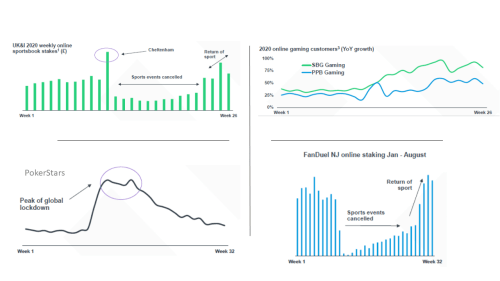

The H1 report also contained specifics on the one-off nature of items like poker revenue and net revenue margins, as below.

The report also shows the extraordinary trends from the height of lock-downs in certain sports and gaming categories, as below.

Guidance also highlighted the need to invest in the poker business and, as a result of heightened spending on items like marketing, the reduction in historical EBITDA margins of over 50% going forward. Based upon the pro-forma 2019 and H1 2020 results, my new projections on a half yearly basis are below.

I estimate that, even with tailwinds in 2020 such as the rescheduled UEFA 2021 Euro soccer tournament, 2021 revenue at £4.8 billion will only be marginally above my new 2020 revenue estimate of £4.6 billion. This assumes sporting events in 2021 return to a semblance of normality! I also estimate that EBITDA (excluding the US) in 2021 will be roughly equal to the 2020 mid guidance of £1.25 billion.

My new estimate of adjusted EPS for 2021 (excluding any SDI impact) is £5.00 which puts the current market valuation at 25 times the 2021 adjusted EPS. There is however a lot of uncertainty around that figure (not least that my estimates are way off base again!). It looks like it will take at least another few quarters before the combined business will stabilize into a more predictable pattern.