Investing can be cruel. Every now and again I find it useful to look back at my investment decisions and try to learn from mistakes. At the beginning of his year, I was knocked sideways about the profit warning from Apple (AAPL) and exited one of my favourite stocks, and one of the most profitable over the previous 5 years, as per this post. If I had ignored all the negative news such as China worries or the implication of the dropping of the iPhone unit disclosures, and blindly held faith, I would have been rewarded by an increase of approximately 77% in the stock since the date of that post! Just shows how clueless this bogger is, dear reader!

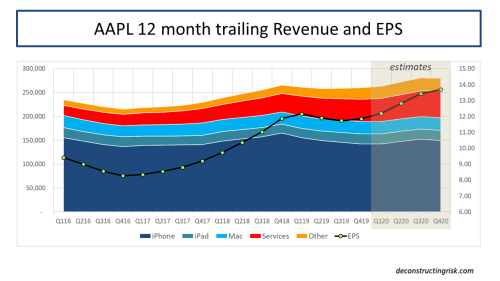

In my defence, the graph below of the actual results for FY2019 illustrate how the issues that confronted AAPL at that time played out (more on the estimates for 2020 later).

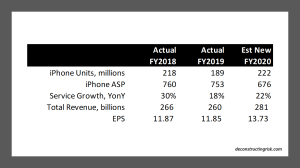

As can be seen clearly by the 12-month trailing revenue split, AAPL’s iPhone revenue plateaued in Q4 2018 and went into decline over FY2019 due to the failure of its strategy to push average iPhone prices higher. Even AAPL discovered that it is not immune to price elasticity. With the introduction of the iPhone 11 and the planned iPhone SE2, AAPL has now reverted its strategy back towards an ASP for the iPhone below $700 whilst it harvests its massive installed base for services. New cheaper handsets and the possibility of a new 5G super-cycle in 2020 has meant that AAPL is once again a market darling. Taking some of the current analyst projections for 2020 and the bullish Q1 2020 guidance from AAPL, I revised my 2020 estimates as below (I, like everybody else, must make my own estimates of handset unit sales each quarter).

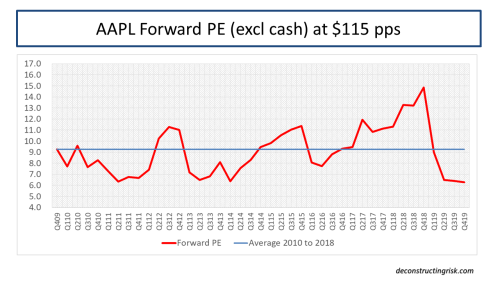

In terms of valuation, if I stick with my trusted AAPL valuation methodology of the forward PE excluding cash ratio analysis, using my EPS estimates for 2020, the stock is currently trading around a 17 PE, approximately 75% above the 10-year average! If I revert to the bull thesis (held before the meltdown late last year) that the market has recognised that AAPL is not purely a hardware firm any longer and deserves a hybrid hardware/software rating to reflect its growing services business, the current price is approximately 30% above the fitted trend line (as a proxy for the hybrid valuation), as below. I will have to come up with a better hybrid valuation methodology in the future but it’ll do for now (all ideas welcome on that front!).

So, the bottom line is that AAPL is richly priced currently but waiting for a perfect entry point may be a mugs game for such a quality firm with the possibility of a new iPhone cycle just beginning. AAPL has yet again shown how it can adapt and change course when its strategy is clearly not working. Still, I’ll be a mug for a while longer to see how this market and overall valuations develop (there will likely be a host of upgrades for AAPL in the coming weeks). I do admit to missing having AAPL in my portfolio, so I will likely not wait too long before establishing an initial position again. If any of the hype around 5G becomes reality as 2020 develops, I can see AAPL being a big benefactor next year.