A continuation of the theme in this post.

The pictures and stories that have emerged from the impact of the tsunami from the Sulawesi earthquake in Indonesia are heart-breaking. With nearly 2,000 officially declared dead, it is estimated that another 5,000 are missing with hundreds of thousands more severely impacted. This event will be used as an vivid example of the impact of soil liquefaction whereby water pressure generated by the earthquake causes soil to behave like a liquid with massive destructive impacts. The effect on so many people of this natural disaster in this part of the world contrasts sharply with the impact on developed countries of natural disasters. It again highlights the wealth divide within our world and how technologies in the western world could benefit so many people around the world if only money and wealth were not such a determinant of who survives and who dies from nature’s wrath.

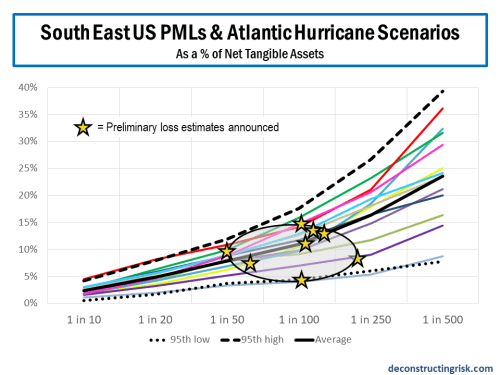

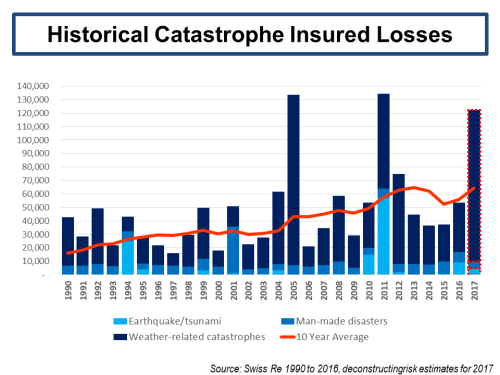

The death toll from Hurricane Florence on the US, in contrast, is around 40 people. The possibility of another US hurricane making landfall this week, currently called Tropical Storm Michael, is unfolding. The economic losses of Hurricane Florence are currently estimated between $25 billion and $30 billion, primarily from flood damage. Insured losses will be low in comparison, with some estimates around $3-5 billion (one estimate is as high as $10 billion). The insured losses are likely to be incurred by the National Flood Insurance Program (NFIP), private flood insurers (surplus line players including some Lloyds’ Syndicates), crop and auto insurers, with a modest level of losses ceded to the traditional reinsurance and insurance-linked securities (ILS) markets.

The reason for the low level of insured loss is the low take-up rate of flood policies (flood is excluded from standard homeowner policies), estimated around 15% of insurance policies in the impacted region, with a higher propensity on the commercial side. Florence again highlights the protection gap issue (i.e. percentage difference between insured and economic loss) whereby insurance is failing in its fundamental economic purpose of spreading the economic impact of unforeseen natural events. Indeed, the contrast with the Sulawesi earthquake shows insurance failings on a global inequality level. If insurance and the sector is not performing its economic purpose, then it simply is a rent taker and a drag on economic development.

After that last sentiment, it may therefore seem strange for me to spend the rest of this blog highlighting a potential underestimating of risk premia for improbable events when a string of events has been artfully dodged by the sector (hey, I am guilty of many inconsistencies)!

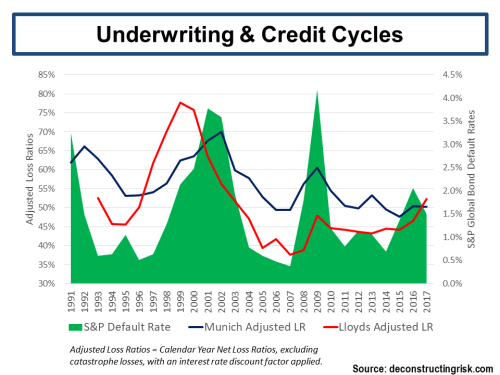

As outlined in this recent post, the insurance sector is grappling with the effect of new capital dampening pricing after the 2017 losses, directly flattening the insurance cycle. It can be argued that this new source of low-cost capital is having a positive impact on insurance availability and could be the answer to protection gap issues, such as those outlined above. And that may be true, although under-priced risk premia have a way of coming home to roost with serious longer-term effects.

The objective of most business models in the financial services sector is to maximise the risk adjusted returns from a selected portfolio, whether that be stocks or bonds for asset managers, credit risks for banks or insurance risks for insurers. Many of these firms have many thousands of potential risks to select from and so the skill or alpha that each claim derives from their ability to select risks and to build a robust portfolio. If for example, a manager wants to build a portfolio of 20 risks from a possible 100 risks, the combinations are 536 trillion (with 18 zeros as per the British definition)! And that doesn’t consider the sizing of each of the 20 positions in the portfolio. It’s no wonder that the financial sector is embracing artificial intelligence (AI) as a tool to assist firms in optimizing portfolios and potential risk weighted returns (here and here are interesting recent articles from the asset management and reinsurance sectors). I have little doubt that AI and machine learning will be a core technique in any portfolio optimisation process of the future.

I decided to look at the mechanics behind the ILS fund sector again (previous posts on the topic include this post and this old post). I constructed an “average” portfolio that broadly reflects current market conditions. It’s important to stress that there is a whole variety of portfolios that can be constructed from the relatively small number of available ILS assets out there. Some are pure natural catastrophe only, some are focused at the high excess level only, the vintage and risk profile of the assets of many will reflect the length of time they have been in business, many consist of an increasing number of private negotiated deals. As a result, the risk-return profiles of many ILS portfolios will dramatically differ from the “average”. This exercise is simply to highlight the impact of the change of several variables on an assumed, albeit imperfect, sample portfolio. The profile of my “average” sample portfolio is shown below, by exposure, expected loss and pricing.

The weighted average expected loss of the portfolio is 2.5% versus the aggregate coupon of 5%. It’s important to highlight that the expected loss of a portfolio of low probability events can be misleading and is often misunderstood. Its not the loss expected but simply the average over all simulations. The likelihood of there being any losses is low, by definition, and in the clear majority of cases losses are small.

To illustrate the point, using my assumed loss exceedance curves for each exposure, with no correlation between the exposures except for the multi-peril coverage within each region, I looked at the distribution of losses over net premium, as below. Net premium is the aggregate coupon received less a management fee. The management fee is on assets under management and is assumed to be 1.5% for the sample portfolio, resulting in a net premium of 3.5% in the base scenario. I also looked at the impact of price increases and decreases averaging approximate +/-20% across the portfolio, resulting in net premium of 4.5% and 2.5% respectively. I guesstimate that the +20% scenario is roughly where an “average” ILS portfolio was 5 years ago.

I have no doubt that the experts in the field would quibble with my model assumptions as they are crude. However, experience has thought me that over-modelling can lead to false sense of security and an over optimistic benefit for diversification (which is my concern about the ILS sector in general). My distributions are based upon 250,000 simulations. Others will point out that I haven’t considered the return on invested collateral assets. I would counter this with my belief that investors should only consider insurance risk premium when considering ILS investments as the return on collateral assets is a return they could make without taking any insurance risk.

My analysis shows that currently investors should only make a loss on this “average” portfolio once every 4 years (i.e. 25% of the time). Back 5 years ago, I estimate that probability at approximately 17% or roughly once every 6 years. If pricing deteriorates further, to the point where net premium is equal to the aggregate expected loss on the portfolio, that probability increases to 36% or roughly once every 3 years

The statistics on the tail show that in the base scenario of a net premium of 3.5% the 1 in 500-year aggregate loss on the portfolio is 430% of net premium compared to 340% for a net premium of 4.5% and 600% for a net premium of 2.5%. At an extreme level of a 1 in 10,000-year aggregate loss to the portfolio is 600% of net premium compared to 480% for a net premium of 4.5% and 800% for a net premium of 2.5%.

If I further assume a pure property catastrophe reinsurer (of which there are none left) had to hold capital sufficient to cover a 1 in 10,000-year loss to compete with a fully collaterised ILS player, then the 600% of net premium equates to collateral of 21%. Using reverse engineering, it could therefore be said that ILS capital providers must have diversification benefits (assuming they do collaterise at 100% rather than use leverage or hedge with other ILS providers or reinsurers) of approximately 80% on their capital to be able to compete with pure property catastrophe reinsurers. That is a significant level of diversification ILS capital providers are assuming for this “non-correlating asset class”. By the way, a more likely level of capital for a pure property catastrophe reinsurer would be 1 in 500 which means the ILS investor is likely assuming diversification benefits of more that 85%. Assuming a mega-catastrophic event or string of large events only requires marginal capital of 15% or less with other economic-driven assets may be seen to be optimistic in the future in my view (although I hope the scenario will never be illustrated in real life!).

Finally, given the pressure management fees are under in the ILS sector (as per this post), I thought it would be interesting to look at the base scenario of an aggregate coupon of 5% with different management fee levels, as below. As you would expect, the portfolio risk profile improves as the level of management fees decrease.

Given the ongoing pressure on insurance risk premia, it is likely that pressure on fees and other expenses will intensify and the use of machines and IA in portfolio construction will increase. The commodification of insurance risks looks set to expand and increase, all driven by an over-optimistic view of diversification within the insurance class and between other asset classes. But then again, that may just lead to the more wide-spread availability of insurance in catastrophe exposed regions. Maybe one day, even in places like Sulawesi.