One of my favourite investing quotes is one from Jim Leitner in Steve Drobny’s excellent book “The Invisible Hands” where he said “investing is the art and science of extracting risk premia from financial markets over time“. Well, there is not much over-priced risk premia to extract these days!

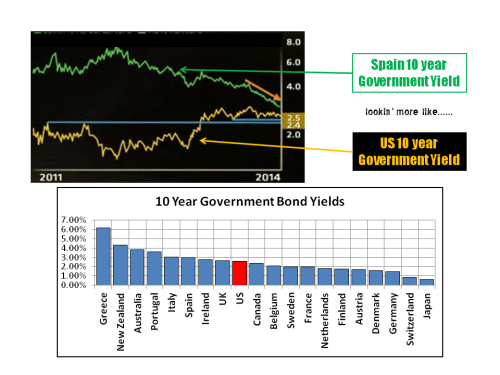

A recent piece on CNBC highlighted the convergence in some sovereign yields as a result of Central Bank intervention in markets. The graph below shows how the 10 year government yield from Spain has converged on that of the US.

In fact, todays’ yields from Italy, Spain & Ireland are within 43, 38 & 15 basis points of the US! Does it make sense from a risk perspective that these countries are so closely priced compared to the US? Clearly not, market prices are being distorted by loose monetary policy across the developed world.

In today’s FT, Martin Wolf highlights the damage that low interest rates can do over the long term (it has been 5 years now after all). He finishes the article with this paragraph:

“Low interest rates are certainly unpopular, particularly with cautious rentiers. But cautious rentiers no longer serve a useful economic purpose. What is needed instead are genuinely risk-taking investors. In their absence, governments need to use their balance sheets to build productive assets. There is little sign that they will. If so, central banks will be driven towards cheap money. Get used to it: this will endure.”

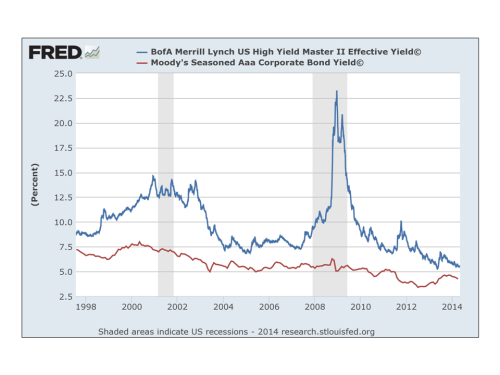

Examples of low risk premia are everywhere. From corporate spreads (as per the graph below), to the influx of capital into insurance linked securities (ILS), to inflated valuations in the stock market.

A recent Bloomberg article cites two market strategists – Chris Verrone of Strategas Research Partners and Carter Worth of Stern Agee – who recommend the purchase of insurance to protect against a stock market pullback. The article states the following:

“While we are not ready to sell stocks across-the-board — there’s still plenty of global support from central banks — we think insuring against a potential pullback makes sense. So we are buying an at-the-money put on the S&P 500 Index with a 30-day maturity. Specifically, we’re looking at the 187 strike put which expires June 6, 2014. It costs $2.54, which equates to 1.4 percent. This is a premium we’re happy to pay in order to sleep more soundly.”

As regular readers will know, I believe a cautious approach is justified in today’s market and, where risk positions have to be maintained, protection using instruments such as options should be sought (if possible). If investing is all about extracting risk premia over time and risk premia is currently mispriced across multiple markets, then the obvious thing to do is simply to go and do something else until those markets correct.

The difficulty is that central bank strategies, as Martin Wolf highlights, are centred on keeping risk premia artificially low over the medium term to stimulate growth through consumption. It is also worrying that when David Einhorn, the hedge fund manager, got to discuss longer term monetary strategy with Ben Bernanke at a dinner in March he concluded that “it was sort of frightening because the answers were not better than I thought they would be”.