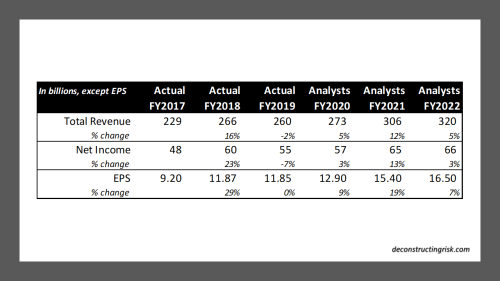

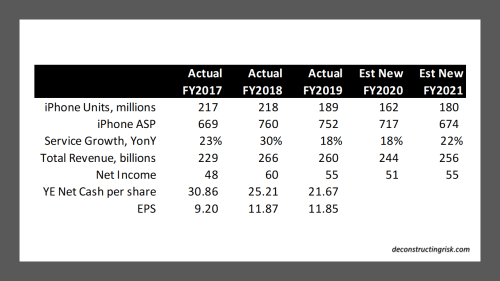

Back in early May, I postulated about AAPL’s future. In a heavily caveated post, I predicted iphone sales down from an assumed 188 million in FY2020 to 162 million and 180 million in FY2021 and FY2022 respectively. Well, AAPL stock is up 63% since that post, breaking past $400 ($100 post-split) at the start of August and now breaking through $500 ($125 post-split). I yet again totally called sentiment wrong on AAPL. The latest analyst estimates are below.

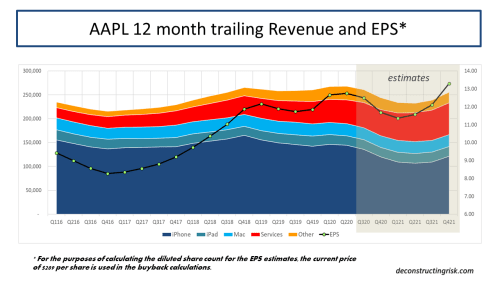

By my calculations, the average analyst estimates are assuming somewhere between 220 to 250 million iphone unit sales for FY2021 and FY2022, in addition to rejuvenated iPad and Mac sales plus strong services and other sales. Notwithstanding the growth in non-iphone items, revenues from iphone will still make up approximately 50% of the total in 2021 and 2022. In short, analysts are calling a monster super-cycle for AAPL on demand for their products as a result of our newly digitalised lives and 5G upgrades. I have been wrong enough times on my AAPL calls to accept these newly optimistic projections for the purposes of this post without comment. That said, the valuation of AAPL is clearly elevated as the following graph from a piece this week on Bloomberg from the ever-excellent John Authers shows.

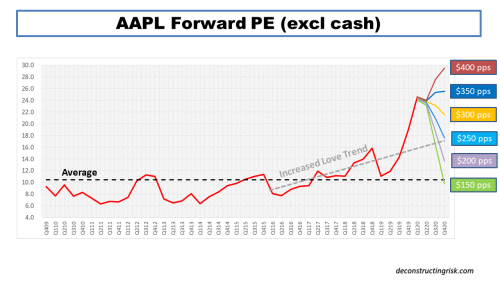

My faithful AAPL chart on forward PE ratios excluding cash using current analysts estimates also illustrates the elevated valuation compared to recent history, as below.

This valuation is despite the risks that exist for AAPL. Navigating the full impacts of the COVID recession on employment and incomes is the obvious headwind. Other current risk includes potential pressure on margins from 5G phones, potential China disruptions from geopolitical tensions between the US and China (e.g. wechat ban), and potential pressure on apple store margins from developers (e.g. fornite/epic quarrel).

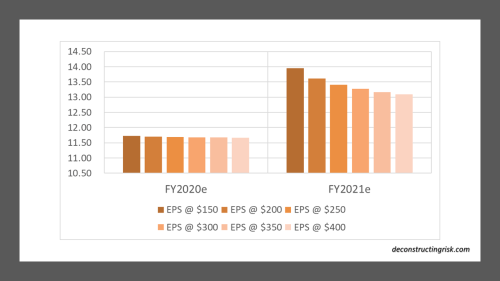

For what it is worth, accepting the sunny analyst projections and a heightened multiple around 20, I would put a sensible price around $340 ($85 post-split). Some mega-bulls on AAPL are raising their targets to $700 ($175 post-split). Given that I never thought we would again see the internet bubble behaviour of stocks rallying due to an upcoming stock split (as per AAPL and TSLA), AAPL is more likely to hit $700 ($175 post-split) than $340 ($85 post-split)!

Crazy silly stuff.