It’s now been 6 weeks since Level3 and TW Telecom announced their intention to merge, as per a previous post. Without any other bidder emerging and with the announcement of the merged entity’s intended management team, basically the existing L3 team with TW senior managers running the US business and the IT side, the deal looks like going ahead absent any unforeseen hic-cup. Level 3 released a S-4 filing which outlined the negotiations and the figures used by each sides’ advisors during the negotiations. I always find the detail behind such deals interesting reading and this is no different, albeit in this case relatively straight forward.

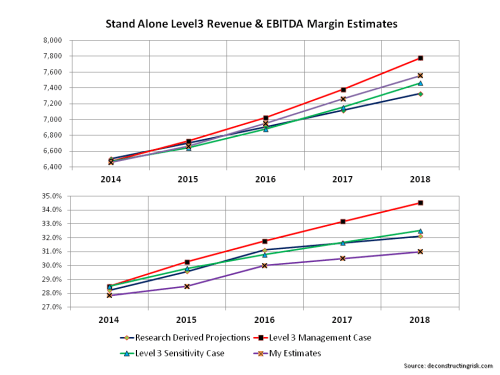

The valuations provided by each of the advisors yielded some interesting data. The management of each side, Level3 and TW Telecom, provide their estimates of future results which the other side then adjusted (the sensitivity case) to use as the basis for the deal. Given that each management team would have tried to maximise the value of their own firm during the negotiations, these estimates are likely optimistic projections. The graph below shows the revenue and EBITDA margin projections of each for a stand alone LVLT compared to the public analysts’ estimates (called Research Derived Projections) and my own estimates.

As my revenues estimates were roughly in the middle of the management estimates and the sensitivity case, I have used the average of both for my new estimates of the combined L3/TW entity as my new base case for valuation purposes. I have also used the EBITDA margin from the sensitivity case as my base with the assumed operating savings of $200 million plus the combined capex of each firm with the full savings assumed of approx $40 million, whereby both cost savings don’t fully kick-in until the 2016 year. The results for the 2016 year are not far off my initial estimates in the previous post with revenues of $8.9 billion, an EBITDA and capex margin of 34% and 15% respectively.

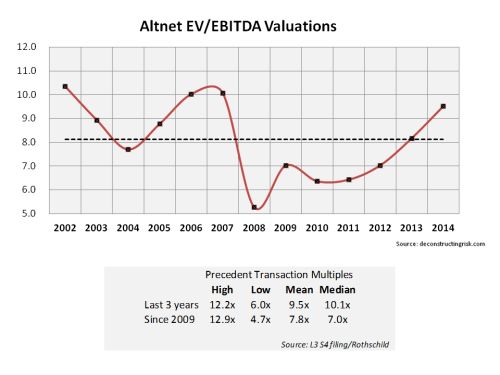

The S-4 outlined the different valuation methods used by the advisors, including DCF and EV/EBITDA multiples. Evercore, one of the advisors, applied a 10x to 13x 2014 EBITDA multiple to determine an implied equity value range and calculated illustrative future stock prices by applying a forward multiple range of 8.5x to 10.7x. Rothschild, another advisor, selected a range of implied EBITDA multiples of 9.5x to 10.5x. The graph below shows the historical multiples for a group of peer firms (although LVLT and TWTC tend historically be above the average peer) that I have kept track of. The graphic also includes the ranges offered by Rothschild.

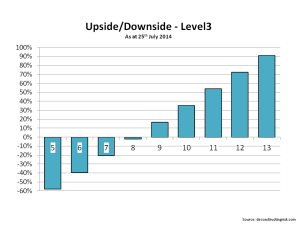

Based upon all of the assumptions above and the balance sheet details offered in the transaction presentation, I calculated the upside & downside to LVLT’s current share price based upon different multiples to the projected 2016 figures. The graph below shows the results (for multiples from 5 to 13).

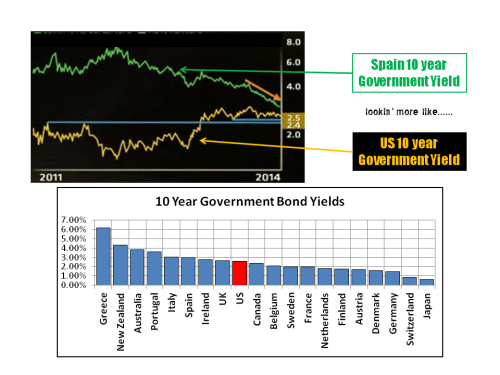

There are a lot of assumptions in the analysis above although I have tended to be conservative. That said I am conscious that LVLT has had a great run-up (equity up 110% over the past 12 months with big gains on the calls) and looks fully valued today based upon execution risks in the TWTC deal, as well as the general frothiness in the US equity market. For those who already own LVLT, buying insurance by way of the January 2015 puts around $35 looks like a sensible course of action here to me. For new comers, I would wait for a better entry point (we may get some wobbles in September although my 2013 September post on the subject last year was way off!!).