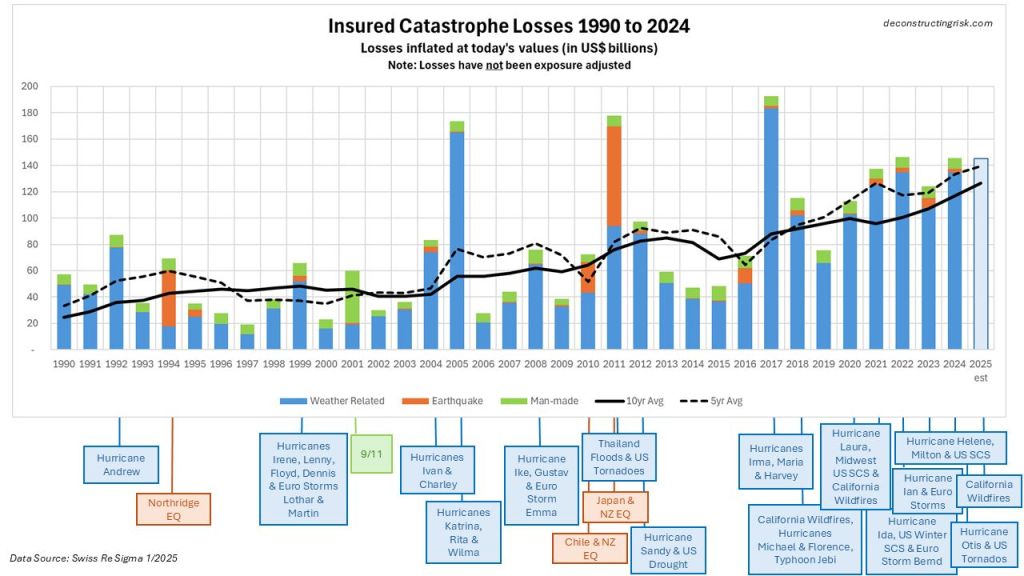

I was recently doing some research on the specialty insurance sector again, a topic I posted regularly on in the past. I googled historical insured catastrophe losses and a response from Google’s AI model Gemini included an old exhibit I had posted on this blog in 2013. I am in two minds about the result, chuffed that something I posted 12 years ago is still being used but perplexed why an exhibit that was so out of date would be relevant! A subject for another day…..

Anyway, the below exhibit updates the inflated insured catastrophe losses from 1990 to 2024 (with Swiss Re’s estimate for 2025). The trend is clearly upwards with the new 10-year average at $130 billion and the 5-year average at $140 billion. This is a significant change from the $60 billion 10 year average in the 2013 post!

As I have highlighted many times previously here, inflated losses (i.e. bringing historical costs into today’s value) are not a true indicator of current risks as the historical losses need to be exposure adjusted (i.e. historical events run through models with today’s exposure date).

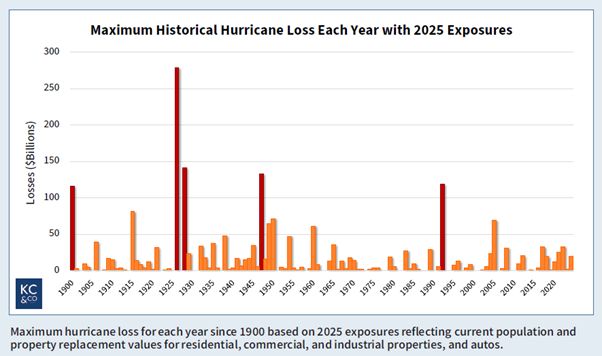

An excellent recent example of this is from a recent paper by Karen Clark & Co called “The $100 Billion Hurricane” which runs each historical US hurricane through 2025 exposures, as below.

The paper concludes that “there is no significant upward trend in hurricane losses, and the US has been lucky over the past few decades”.

Two different angles of looking at historical data albeit that it’s undeniable that catastrophe losses, both by economic and insured value, in aggregate each year are only going in one direction.

Let’s hope the remainder of the 2025 US hurricane season doesn’t show us that the single $100 billion hurricane loss was overdue!