As regular readers will know, I have posted on Level 3 (LVLT) many times over the years, more recently here. I ended that post with the comment that following the firm was never boring and the announcement of a merger with CenturyLink (CTL) on the 31st of October confirmed that, although the CTL tie-up surprised many observers, including me.

Before I muse on the merger deal, it is worth looking over the Q3 results which were announced at the same time as the merger. The recent trend of disappointing revenue, particularly in the US enterprise business, was compounded by an increased projection for capex at 16% of revenue. Although the free cash-flow guidance for 2016 was unchanged at $1-$1.1 billion, the lack of growth in the core US enterprise line for a second quarter is worrying. Without the merger announcement, the share price could well have tested the $40 level as revenue growth is core to maintaining the positive story for the market, and premium valuation, of Level 3 continuing to demonstrate its operating leverage through free cash-flow growth generation.

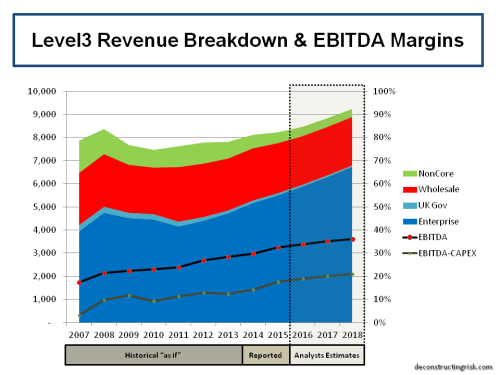

Level 3 management acknowledged the US enterprise revenue disappointment (again!) and produced the exhibit below to show the impact of the loss of smaller accounts due to a lack of focus following the TW Telecom integration. CEO Jeff Storey said “coupling our desire to move up market, with higher sales quotas we assigned to the sales team and with compensation plans rewarding sales more than revenue, we transitioned our customers more rapidly than they would have moved on their own”. The firm has refocused on the smaller accounts and realigned sales incentives towards revenue rather than sales. In addition, LVLT stated that higher capex estimate for 2016, due to strong demand for 100 Gig wavelengths and dark fibre, is a sign of future strength.

Although these figures and explanations do give a sense that the recent hiccup may be temporary, the overall trends in the sector do raise the suspicion that the LVLT story may not be as distinctive as previously thought. Analysts rushed to reduce their ratings although the target price remains over $60 (although the merger announcement led to some confused comments). On a stand-alone basis, I also revised my estimates down with the resulting DCF value of $60 down from $65.

Many commentators point to overall revenue weakness in the business telecom sector (includes wholesale), as can be seen in the exhibit below. Relative newcomers to this sector, such as Comcast, are pressuring tradition telecoms. Comcast is a firm that some speculators thought would be interested in buying LVLT. Some even suggest, as per this article in Wired, that the new internet giants will negate the need for firms like Level 3.

However, different firms report revenues differently and care needs to be taken in making generalisations. If you take a closer look at the revenue breakdown for AT&T and Verizon it can be seen that not all revenue is the same, as per the exhibit below. For example, AT&T’s business revenues are split 33%:66% into strategic and legacy business compared to a 94%:6% ratio for LVLT.

That brings me to the CenturyLink deal. The takeover/merger proposes $26.50 in cash and 1.4286 CTL shares for each LVLT share. $975 million of annualised expense savings are estimated. The combined entity’s debt is estimated at 3.7 times EBITDA after expense savings (although this may be slightly reduced by CTL’s sale of its data centres for $2.3 billion). LVLT’s $10 billion of NOLs are also cited by CTL as attractive in reducing its tax bill and maintaining its cherished $2.16 annual dividend (CTL is one of the highest yield dividend plays in the US).

The deal is expected to close in Q3 2017 and includes a breakup fee of about $2 per LVLT share if a 3rd party wants to take LVLT away from CTL. Initially, the market reaction was positive for both stocks although CTL shares have since cooled to $23 (from $28 before the deal was announced) whilst LVLT is around $51 (from $47 before) which is 13% less than the implied takeover price. The consistent discount to the implied takeover price of the deal since it was announced suggests that the market has reservations about the deal closing as announced. The table below shows the implied value to LVLT of the deal shareholders depending upon CTL’s share price.

CTL’s business profile includes the rural consumer RBOC business of CenturyTel and nationwide business customers from the acquired business assets of Qwest and Sprint. It’s an odd mix encompassing a range of cultures. For example, CTL have 43k employees of which 16k are unionised. The exhibit below shows the rather uninspiring recent operating results of the main segments.

CTL’s historical payout ratio, being its dividend divided by operating cash-flow less capex, can be seen below. This was projected to increase further but is expected to stabilise after the merger synergies have been realised around 60%. The advantage to CTL of LVLT’s business is an enhancement, due to its free cash-flow plus the expense synergies and the NOLs, to CTL’s ability to pay its $2.16 dividend (which represents a 9.4% yield at its current share price) at a more sustainable payout rate.

For LVLT shareholders, like me, the value of the deal all depends upon CTL’s share price at closing. I doubt I’ll keep much of the CTL shares after the deal closes as CTL’s post merger doesn’t excite me anywhere as much as a standalone LVLT although it is an issue that I am still trying to get my head around.

As per the post’s title, I’m confused but content about events with LVLT.