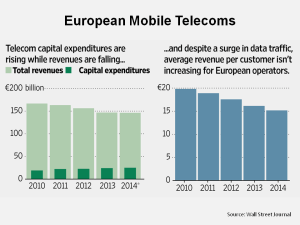

After many years of forecasted telecom consolidation in Europe, the recent uptick in M&A activity in the European communications sector is turning into frenzy. The catalyst includes European regulator’s agreement to allowing consolidation from four to three operators in mobile markets in Germany, Ireland and Austria. Declining mobile revenues & ARPU, the capital expense required to upgrade networks to 4G and buy spectrum, and the popularity of the quad play (bundled mobile and fixed telephone, broadband & TV) in certain markets are other catalysts. The graph below from the Wall Street Journal highlights the trends in the European mobile market.

BT is a central player in the frenzy and reported to be looking at accelerating its mobile strategy by purchasing either EE (owned jointly by Orange and T-Mobile) or O2 (owned by Telefonica) in the UK. Vodafone will need to respond to such a development and is reported to be assessing a bid for Liberty Global. Hutchison Whampoa, owner of mobile provider Three, is also reported to be considering its options. Sky and TalkTalk are talked about as possible targets in the UK.

The list of recent deals is long. O2 and KPN’s E-Plus merged in Germany. Vodafone purchased Ono in Spain and Kabel Deutschland in Germany with its Verizon booty. Liberty Global recently completed its acquisition of Ziggo in the Netherlands. Altice, owner of cable operator Numericable, bought SFR in France and, in Portugal, it’s just announced a deal for the Portuguese assets of Portugal Telecom from Brazil’s Oi. Hutchison Whampoa bought Orange in Austria and O2 in Ireland. France’s Orange is buying Jazztel in Spain.

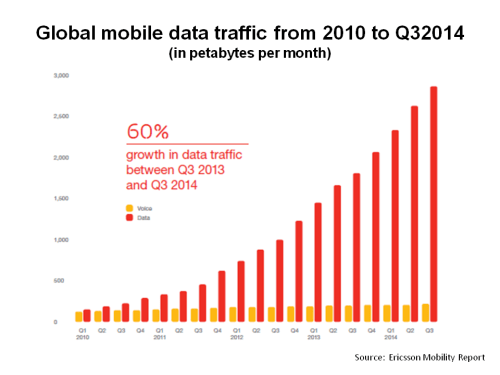

The attraction of combining mobile traffic with fixed assets is highlighted by the growth in data traffic over connected devices like smart-phones as an exhibit from the Ericsson Mobility report below shows.

A recent article from the FT speculated on other combinations in the European telecom sector. France’s Iliad, who made an audacious yet unsuccessful bid for T-Mobile in the US, may have another crack at Bouygues Telecom (maybe with SFR-Numericable taking some assets). In Italy, Hutchison Whampoa, owner of 3 Italia, may have a go at the debt heavy Wind, although the part ownership by the Russian Vimplecom may be an issue.

I haven’t taken an active (or economic) interest in the sector in Europe since Virgin Media came out of Chapter 11 and was subsequently bought out by Liberty Global a few years later. Although I have looked at Liberty Global a few times since, I couldn’t get over the valuation at the time or the massive goodwill/intangible items from its acquisitive history (currently over 40% of total assets). Liberty’s debt load of over 4.5 times EBITDA is scary but not overtly so given its strong cash-flow. At a current enterprise value (EV) to EBITDA multiple of 9.5, a merger with Vodafone would not be cheap (which currently trades around a 7.6 EV/EBITDA multiple with a lower net debt to EBITDA ratio of less than 2.5). A Vodafone/Liberty merger would be a fascinating test for European regulators as such a match-up would have been unthinkable just a few quarters ago.

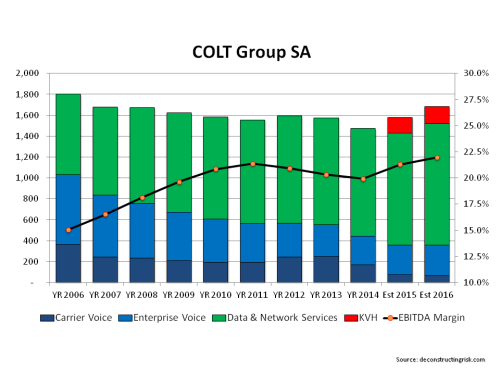

The only European telecom firm that I have kept up with is the disappointing COLT (who I posted on here and here). COLT may get caught up in the merger frenzy as a target. I suspect majority owner Fidelity is looking to exit whilst maximising its value (or minimising its loss is more accurate in this case). COLT recently bought the Japanese operator KVH (who also had Fidelity as an owner). I updated my projections, as below, but given that COLT will likely spend most of its cash pile on the KVH acquisition and integration, the medium term operational outlook for COLT looks uninspiring. COLT does have a €150 million debt facility which is more than enough to get it to free cash-flow (I estimate that will not be until 2017 with KVH integration costs), unless of course it goes shopping!

So overall, the European sector is getting really interesting and, although I can’t see any obvious way to play it that excites me, it will be fascinating to watch from the side-lines.