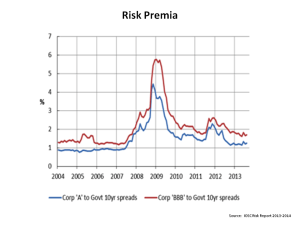

The IMF today warned about rising global financial stability risks. Amongst the risks, the IMF highlighted the “continued financial risk taking and search for yield keep stretching some asset valuations” and that “the low interest rate environment also poses challenges for long term investors, particularly for weaker life insurance companies in Europe”. The report states that “the roles and adequacy of existing risk-management tools should be re-examined to take into account the asset management industry’s role in systemic risk and the diversity of its products”.

In late March, Swiss Re issued a report which screamed that the “current high levels of financial repression create significant costs and lower long-term investors’ ability to channel funds into the real economy”. The financial repression, as Swiss Re calls it, has resulted in an estimated loss of $470 billion of interest income to US savers since the financial crisis which impacts both households and long-term investors such as insurance companies and pension funds.

Many market pundits, Stanley Druckenmiller for example, have warned of the destabilizing impacts of long term low interest rates. I have posted before on the trend of hedge funds using specialist insurance portfolios as a means to take on more risk on the asset side of the balance sheet in an attempt to copy the Warren Buffet insurance “float” investment model. My previous post highlighted Richard Brindle’s entry into this business model with a claim that they can dynamically adjust risk from one side of the balance sheet to the other. Besides the influx of hedge fund reinsurers, there are the established models of Fairfax and Markel who have successfully followed the “Buffet alpha” model in the past. A newer entry into this fold is the Chinese firm Fosun with their “insurance + investment twin-driver core strategy”.

The surprise entry by the Agnelli family’s investment firm EXOR into the Partner/AXIS marriage yesterday may be driven by a desire to use the reinsurer as a source of float for its investments according to this Artemis article on the analyst KBW’s reaction to the new offer. In the presentation on the offer from EXOR’s website, the firm cites as a rationale for a deal the “opportunity to exploit know-how synergies between EXOR investment activities” and the reinsurer’s investment portfolio.

Perhaps one of the most interesting articles on the current market in recent weeks is this one from the New York Times. The article cites the case of how the private equity firm Apollo Global Management purchased Aviva’s US life insurance portfolio, ran it through some legit regulatory and tax arbitrage structures with Goldman Sachs help, and ended up using some of the assets behind the insurance liabilities to prop up the struggling casino company behind Caesars and Harrah’s casinos. Now that’s a story that speaks volumes to me about where we are in the risk appetite spectrum today.