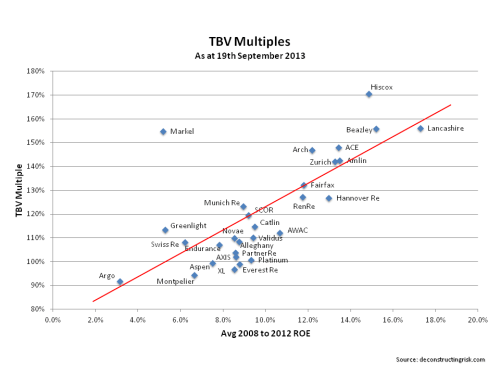

As it has been almost 6 months until my last post on the tangible book value multiples for selected reinsurers and specialty insurers I thought it was an opportune time to post an update, as per graph the below.

click to enlarge

I tend to focus on tangible book value as I believe it is the most appropriate metric for equity investors. Many insurers have sub-debt or hybrid instruments that is treated as equity for solvency purposes. Although these additional buffers are a comfort to regulators, they do little for equity investors in distress.

I tend to focus on tangible book value as I believe it is the most appropriate metric for equity investors. Many insurers have sub-debt or hybrid instruments that is treated as equity for solvency purposes. Although these additional buffers are a comfort to regulators, they do little for equity investors in distress.

In general, I discount intangible items as I believe they are the first thing that gets written off when a business gets into trouble. The only intangible item that I included in the calculations above is the present value of future profits (PVFP) for acquired life blocks of business. Although this item is highly interest rate sensitive and may be subject to write downs if the underlying life business deteriorates, I think they do have some value. Whether its 100% of the item is something to consider. Under Solvency II, PVFP will be treated as capital (although the tiering of the item has been the subject of debate). Some firms, particularly the European composite reinsurers, have a material amount (e.g. for Swiss Re PVFP makes up 12% of shareholders equity).

How do you come up with a TBV multiple north of 1.5 for MKL ? According to the Q2 2013 10-Q they had equity (including minorities) of USD 6.32 bn, Goodwill of USD 1.04 bn and market cap as of right now (cob Sept 19) is circa USD 7.28 bn. This gives a tangible book value of USD 5.28 bn and accordingly price/tangible book of around 1.38 (= 7.28 / 5.28).

And yes, I got a soft spot for MKL…

Best,

Eddie

Hi Eddie,

I also took off other intangibles of $0.6b. I do keep other intangibles in for certain items like present value of future profits for life businesses. In Markel’s case it includes items like customer relationships, page 11 of 10K, which I dislike. That said, I haven’t done detailed analysis of their intangibles. Open to persuasion!

M

Ok, I see what you mean.

I don’t have the docs in front of me so take all figures with a pinch of salt. Intangibles consist of customer relationships, IT and a license for the London insurance market iirc.

The license was worth USD 25mn or so, not to much, but I presume it can be either sold outright or via a spin-off, so it should be worth something (and USD 25mn ain’t much).

IT is written down over four years. Management keeps saying (and I tend to believe them…) that they keep spending money on IT, so again it should be worth something. Four years to write it off is also reasonable.

Customer relationships… In an old Letter to Shareholders (2008 or 2010 iirc) they say that they retain about 80% of their customers YoY. Since they deal in yearly contracts and a lot of competition goes over the price imo 80% retention is not too shabby. Without those recurring customers they would have to find new ones, either by lowering their prices (which they claim they won’t do so it will cost them revenue) or some kind of maketing which also costs money. Which lets me believe that this intangible is also worth something (you suffer a loss without it and would need money to reproduce it).

We could discuss the whole night whether the figures are accurate or not without coming to a conclusion. I simply took managements figures (maybe with a 10% discount, just to be on the safe side) and added them (resp didn’t deduct them).

My favorite examples for these things are Procter & Gamble (c. 40% of all assets are intangibles) and Reckitt Benkiser (c. 70% here last time I checked). I fully believe that P&Cs intangible are worth a lot: these are brands everyone knows, even without knowing that those belong to P&C (we talk about c. 40 brands). Otoh Reckitt claims a lot more value for 12 brands which are not as strong as P&Cs imo (Vanish Oxygen for example). So I tend to believe these intangibles are worth a lot less than they say.

Cheers,

Eddie

It is amazing how large intangibles can be in some sectors. I just view them as items that disappear in the hard times and generally can’t be relied upon.

Generally for P&C, if you are downgraded or have a big negative event like a reserve hit (TWGP is a live example!) its hard to be kept on broker or insured credit lists. AIG undoubting got through by virtue of the government backing (still haven’t got to that, weather too good this weekend!). I agree that for some niche lines (which I think is a big US focus for Markel?) customer loyalty is a factor but in the wholesale/London market type stuff its much more about price and ratings. So, it maybe conservative but I prefer to discount all intangibles. Even for the present value of future profits (PVFP) item which I keep in, I am in two minds. Its a very interest rate sensitive item and if the life business is going bad its likely the profit potential will also be written off. For some European composite (re)insurers, its a considerable item. Swiss and SCOR for example PVFP makes up 12% and 21% of equity respectively!!

All the best.

M

Re Markel: yes, one of their main business lines is specialty insurance in niches like racing horses or oldtimers. My impression is that it is not easy to get coverage there and if you get some price may be not the only criterion. Completly different story if we talk about automotive insurance for example (GEICO anyone ?).

Re AIG: I spent several weeks reading their Ks and Qs and also some presentations and call transscipts… so no need to worry !

Fully agree on the PVFP. Long-term business that depends on tons of assumptions (remember what happend to the secondary life insurance market in the US when they adjusted the mortality tables in 2008 ?) is prone to all kinds of errors. Usually those do not run in your favor… Same with pension liabilities btw (one of my pet themes).

Best,

Eddie