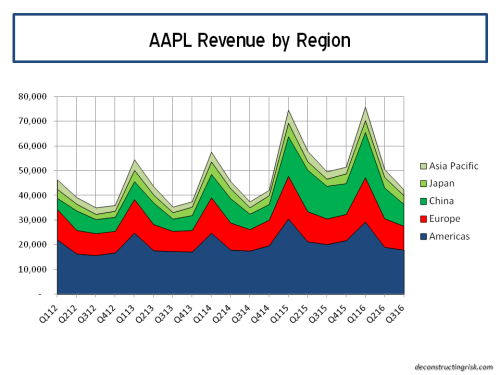

Recently I have been trying to dig deeper into Apple (AAPL) to get a handle on what the near term may mean for this amazing company and thereby get an insight into APPL’s valuation. I have struggled with AAPL’s valuation in previous posts (here and here) but after each of my musings the share price continued on its upward trajectory.

Irrespective of whether iPhone 8 and iPhone X unit sales disappoint (due to unit shortages or otherwise) over the coming months, it seems highly probable to me that Apple will be successful in segmenting their iPhone market further over the medium term and break through the $1000 per iPhone spend in a significant way. Their R&D spend of over $10 billion (including nearly $2 billion of share options) goes a long way to ensuring customers will pay for their innovations.

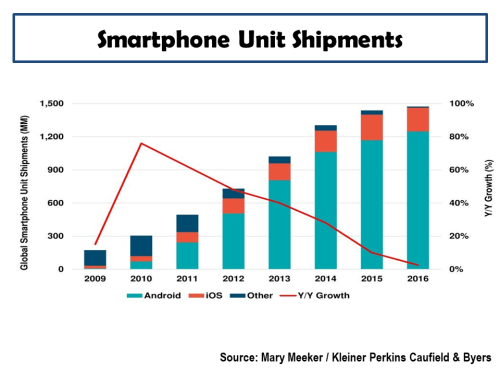

The reason why AAPL are following the current strategy is a hot topic of debate with analysts. Some see the new iPhone models feed into a super-cycle of updates and continued installed base growth, pointing to the approximate 40% of the current iPhone installed base older than 2 years. Other analysts believe that the smartphone market has plateaued (see graph from Mary Meeker below) and Apple is embarking upon a segmentation strategy to harvest their loyal customer base.

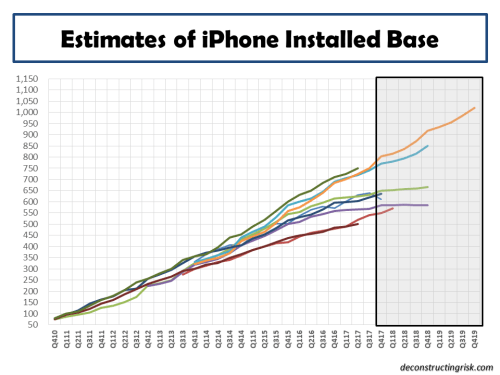

The estimates for the iPhone installed base vary significantly across analysts from 550 to 750 million units and some, such as Deutsche Bank and BoA ML further, break the base down to core and secondary non-core users. Although most of the estimates are likely out of date as they were published prior to the iPhone 8 and iPhone X announcements, the graphic below illustrates the differing views.

It is likely no surprise that I am in the plateau camp on future growth of the installed base. I have assumed an installed base of 640 million as at end September 2017 and 40% or approximately 250 million of these are potential iPhones upgraders with phones older than 2 years. I have further assumed that a proportion of the installed base, I selected 10%, are secondary non-core users with a very low propensity to upgrade. That leaves an approximate 190 million potential upgrades for the FY2018. Despite the lack of growth of the market, I assumed another 10 million sales from new purchasers giving a target iPhone unit sales of 200 million for FY2018. 200 million of annual unit iPhone sales is well below most analyst estimates which average around 240 -260 million for FY2018.

Of the 200 million iPhone unit sales for FY2018, I have further assumed 45 million are iPhone X and just over half are iPhone 8, with the remainder being iPhone 7 and older models. For Q42017, I am assuming only 9 million iPhone 8 sales with 35 million of iPhone 7 and older models (influenced by the amount of inventory clearance sales I have seen in retail stores). The graph below shows my installed base assumptions, with my estimates for sales of the iPhone 8, iPhone X and it successor models over FY 2018 and FY2019 (I am assuming 200 million units is the new normal for annual iPhone sales through to FY2020).

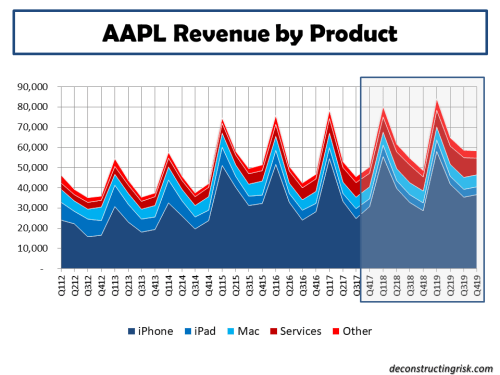

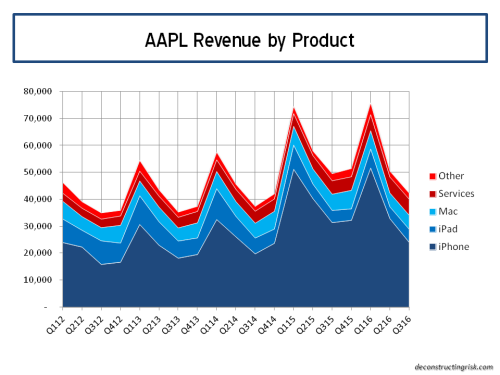

The resulting average selling price (ASP) for FY2018 is $785 with annual FY2018 revenues from iPhone of $157 billion. For FY2019, I have assumed a ASP of $860 with annual FY2019 iPhone revenues of $172 billion. The graph below shows my revenue assumptions over FY 2018 and FY2019 across all products.

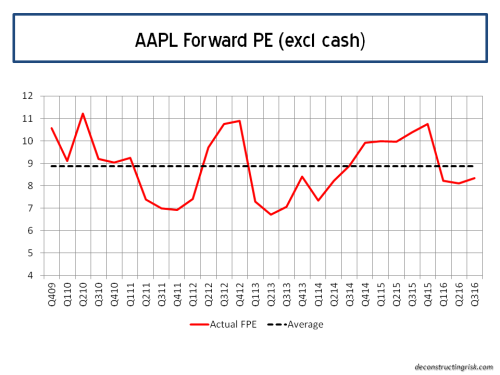

The EPS estimates coming out of my model, using the assumptions above (amongst others), for FY2018, FY2019 and FY2020 are $10.17, $11.45 and $11.81 respectively (I agree with the estimates of $9.00 for FY2017). That represents 13% EPS growth for 2018 and 2019, slowing to 3% in 2020. At the current share price of $160, the forward PE (excluding cash) would look as per the graph below.

My analysis suggests that AAPL either deserves a higher multiple than the recent past to justify its current value or it will have to convince enough new iPhone users to buy its new products to take market share from its competitors and sell more than 200 million iPhone annually for the foreseeable future.

Given the potential headwinds for iPhone 8 and iPhone X over the short term, the current price may be difficult to defend near term as the market gets used to lower iPhone sales at higher prices (and hopefully margins too). Then again, going negative on AAPL hasn’t proven fruitful in the past and the analysts are currently hyping up AAPL’s prospects with price targets heading solidly towards $200.

Given my previous history of questioning AAPL’s valuation, maybe indecision is the best answer for the time being……