Last week, Raghuram Rajan, the current governor of the Indian Central Bank and the author of the excellent book Fault Lines, warned about asset prices and macro-economic policies in the developed world. Rajan said that things may work out if “we can find a way to unwind everything steadily” but added “it is a big hope and prayer” and that the reality of history is one of sudden movements and volatility. Also this week, hedge fund manager David Einhorn said that his fund was having “difficult time finding new investments this quarter” and that “as the market continues to rise in the face of conflicting economic data, global unrest, and looming overdue Fed exit from quantitative easing we remain cautiously positioned”.

As regular readers will know, I am also wary about valuations in the current market which seem to be largely driven by the lack of return as a direct result of macro-economic policy (see Buttonwood post). I am comforted by the fact that, as a part-time investor, I am not bound by the pressures that professional money managers have in the beauty parade that is the relative annual performance competition. So that affords me and other part-time investors (our own family offices in a way!!) the luxury of watching developments from the sidelines. Trying to find the holy grail of an undervalued stock in today’s market is unrealistic and fanciful in my opinion, given the resources of a lone investor at one’s disposal. So I tend to let my attention drift to whatever comes my way with the intention of broadening my mind and maybe broadening my list of stocks to keep an eye on.

That brings me to my visit to the dentist last week. My visit was primarily to get a new crown on a neglected tooth. I had rescheduled the appointment a number of times and as a result had not really thought about the procedure beforehand. Compared to a similar procedure a number of years ago, the process was totally different. First off, my mouth was scanned by a camera and a 3D image of my teeth was produced. I was then asked to wait in the reception for 20 minutes and upon my return the ceramic crown was ready having been produced in a milling machine onsite. The crown fit perfectly and was easily fitted. My dentist conducted the procedure using a new one-day crown system produced by a German firm called Sirona Dental Systems. The system includes a computer that takes digital images of the damaged tooth, software to design the crown and a milling machine. There have been some concerns about the use of such crowns for front teeth due to colouring issues or the suitability of such crowns for people who grind their teeth heavily. Within my mouth, I have a live comparative test of a laboratory fabricated crown and a new one day procedure produced one. It will be interesting to see how the new crown gets on!

I had previously heard about new technology that could impact the dental sector. A specially designed camera, fitted to a smart phone, can scan your mouth and then send a 3D image to a central database whereupon a panel of dental experts could diagnose the issue and then submit the recommended procedure to a marketplace of dentists to provide a quote on a solution. Naturally, my dentist was skeptical on diagnosing problems with a smartphone scan! Given my first experience with a scan, I think such ideas may have potential to disrupt a protected professional sector. As a further illustration of how technology is impacting medicine, this article on a new app that can turn a smartphone into a highly portable and low cost eye scanner to diagnose eye health issues in remote areas is interesting.

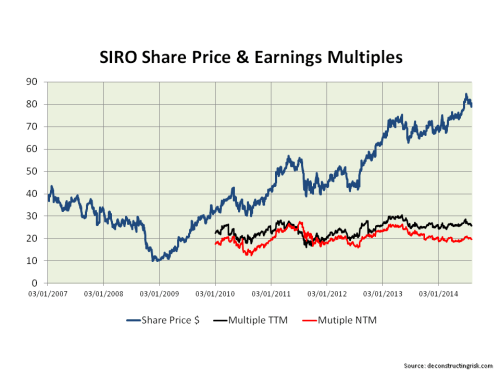

So I had a look at Sirona, ticker SIRO, who coincidentally reported quarterly results last week. SIRO’s year end is September and, based upon an estimate for Q4, revenue has grown on average by 9% for the last 3 years with operating income by 15%. The stock price has doubled over that time. The graph below shows the share price since 2007 and the 12 month trailing PE ratio and the next 12 months (current quarter and estimated next 3 quarters) PE estimate.

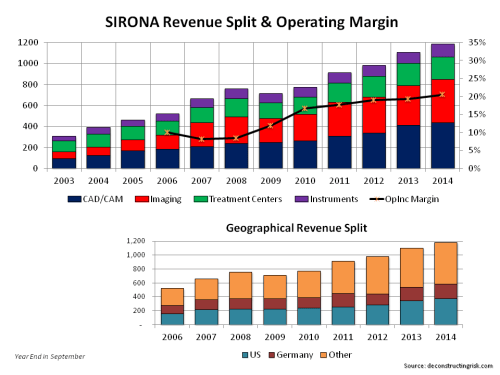

SIRO’s revenue is split into 4 main segments: dental CAD/CAM systems (such as the one I experienced), imaging systems, treatments centers, and instruments. The first two segments are the larger making up approximately 35% of revenue each and are the higher growth and margin segments. Each are described below:

- Dental CAD/CAM systems address the market for dental restorations, which includes several types of restorations, such as inlays, onlays, veneers, crowns, bridges, copings and bridge frameworks made from ceramic, metal or composite blocks. SIRO estimates it has an approx 15% market share in US and Germany.

- Imaging systems comprise a broad range of systems for diagnostic imaging in the dental practice. SIRO has developed a comprehensive range of imaging systems for 2D or 3D, panoramic and intra-oral applications that allow the dentist to accommodate the patient in a more efficient manner.

- Treatment centers comprise a broad range of products from basic dentist chairs to sophisticated chair-based units with integrated diagnostic, hygiene and ergonomic functionalities, as well as specialist centers used in preventative treatment and for training purposes.

- SIRO offers a wide range of instruments, including handheld and power-operated handpieces for cavity preparation, endodontics, periodontology and prophylaxis, which are regularly updated and improved.

The graph below shows the historical segment & geographical revenue split and the historical operating margin.

The growth in operating results is impressive, as is their balance sheet and cashflow. The issue is one of valuation with SIRO trading around 26 times this year’s earnings and about 20 times next year’s projected earnings. However, despite SIRO having some major competitors, they are growing their highest margin segments impressively and, in the vein of Peter Lynch’s philosophy of investing in what you know, I shall be putting SIRO on my watch list to keep an eye on them whilst I do some more research (the most obvious of which is seeing how my crown gets on!!) and wait for a better entry point.

Speaking of valuations, my dental experience did get me thinking about the much hyped 3D printing sector. The number of applications for 3D printing continues to grow from construction, to aerospace, to medical/dental, to fashion, to biotech, to a whole host of industrial design applications. Wohlers Associates project a CAGR of 30% for the sector over the next few years (I’d love to know on what basis these guys come up with their projections). I had a brief look over two of the most hyped firms in the sector – Stratasys Ltd (SSYS) and 3D Systems (DDD). Historical comparisons are difficult as both companies have been aggressive acquirers. SSYS has had more favourable results of late compared to DDD due to SSYS acquisition of MakerBot and to DDD’s recent stumble due to heavy investments in growth. A quick snapshot of some metrics since 2011 are in the graphs below.

With SSYS and DDD trading at 36 and 40 times next year’s projected earnings respectively, these firms are not for the faint hearted. Hyper growth stories in new sectors are normally areas outside my comfort zone due to the inherent uncertainties. In this case my experience at the dentist may mean I will do some more digging in the future of this new technology, time permitting. For the sake of curiosity if nothing else.