It has been about 10 months since I posted on the potential for the Paddy Power and Betfair merger and a lot has happened since. Brexit and the resulting sterling volatility are obvious events of significance. In the betting sector, consolidation has continued with the Ladbrokes and Gala Coral merger having been announced and approved. The audacious proposed tie up by Rank and 888 on William Hill floundered with recent press reports suggesting Rank and 888 could get together. The consolidation in this rapidly changing sector is far from over.

The initial optimism on the future prospects for the two high achieving entities, Paddy Power and Betfair, resulted in the share price trading above the £100 level earlier in the year. Following Brexit, it traded as low as £80. The merged firm reported their H1 figures earlier this week which showed the full extent of the merger costs and provided an increased cost synergies figure for 2017 of £65 million. With 75% of EBITDA being sterling based, the currency impact was not as material as their multi-jurisdictional operations would suggest.

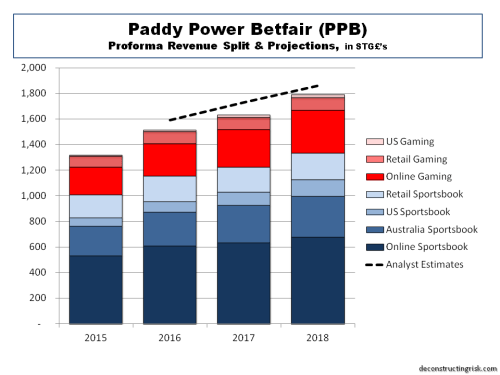

Top-line results for H1 do however indicate that 2016 revenue growth will likely not be as high as the 17% I had expected in November. The reality of issues in this regulated and highly competitive sector also served as a reminder that the path may not be as smooth as initially hoped for. Regulatory headwinds in Australia were an example. As a result, I revised my revenue estimates in November from £1.64 billion to £1.51 billion. The graph below shows the breakdown of my revenue estimates for the next few years with a comparison to overall average analyst estimates.

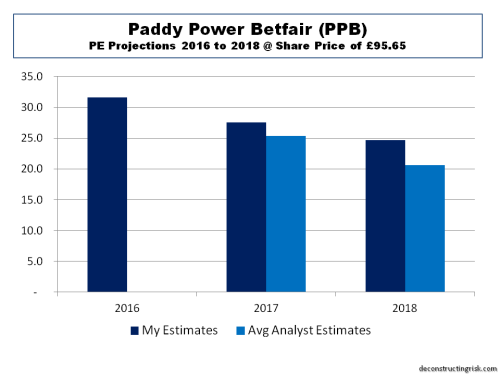

Also, I have revised my previous earnings estimates with an operating profit margin of 20% for 2016, growing to 22% in 2017 and 23% in 2018. Based upon a share count of 86 million as at end June 2016 (which includes 2 million treasury shares), I estimate the H2 EPS at £1.55 which when added to the H1 EPS of £1.45 gives a full year 2016 EPS of £3.02.[ This 2016 estimate does represent an operating EPS of £3.79 which compares to my November estimate of £3.85 albeit that the November estimate was based upon suspect figures like the share count!!]. At today’s share price of £95.65, the PE multiple for 2016 is a hefty 31.6. The graph below shows the multiple based on my EPS estimates for 2016, 2017 and 2018 compared to those using the average analyst estimates.

In conclusion, I remain optimistic about the business model of Paddy Power Betfair particularly given the proven quality of the management team and their history of execution. However, quality doesn’t come cheap and the current valuation is priced for perfection. For new investors, it may be prudent to wait for a better entry point.