While waiting for earnings season to show how firms are forecasting the impact of macro trends, it’s a good time to look over some investing ideas for the future. Having a few names selected that can be picked up in market weakness is always a good way of building quality positions. It also helps in viewing current positions to see if they stack up to alternatives.

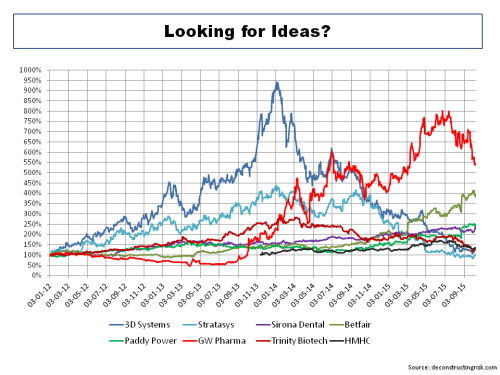

Regular readers will know that I think the insurance sector is best left alone given pricing and competitive pressures. Despite the odd look from afar, I have never been able to get comfortable with hot sectors such as the Chinese internet firms (as per this July post). The hype around new technologies such as 3D printing has taken a battering with firms like 3D Systems and Stratasys bursting the bubble. A previous post in 2014 highlighted that a focussed play on 3D printing such as Sirona Dental makes better sense to me. The Biotech sector is not one I am generally comfortable in as it seems to me to be akin to leveraged one way bets (loss making firms with massive potential trading a large multiples of revenue). Firms such as GW Pharma which are looking at commercializing cannabinoid medicines for multiple sclerosis, cancer and epilepsy have had the shine taken off their gigantic runs in the recent volatility. My views on Trinity Biotech (which is not really a biotech firm) were expressed in a recent post in May and haven’t really changed despite a subsequent 25% drop. I need to see more results from TRIB to get comfortable that the core business justifies the current valuation with the upside being in the FDA approval of the Troponin point-of-care cardiac tests. Other ideas such as online education firm Houghton Mifflin Harcourt (in this post) have failed to sparkle.

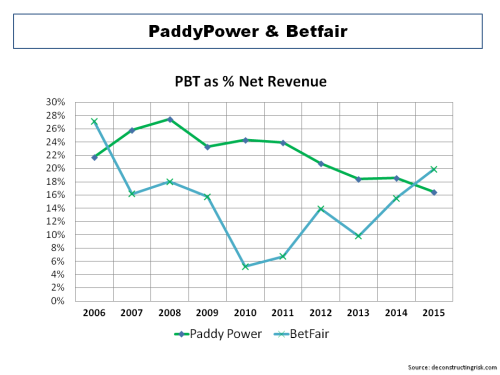

This leads me to the online gambling sector that I have posted on many times (here and here for example) and specifically to the Paddy Power/Betfair merge. My interest in this sector has not been one from an investment point of view (despite highlighting that PP and Betfair would make a good combination in May!) but I can’t get the recent performance of these two firms out of my head. The graph below shows the profit before tax margins of each (with my estimate for 2015).

One of the things that stand out is how Betfair’s margin has improved, despite the recent headwinds such as the UK point of consumption (POC) tax. Indeed the market view that Betfair CEO Breon Corcoran is the new messiah can best be illustrated in the graph below on the firm’s performance since he took charge (revenue in sterling). It shows solid revenue growth (particularly from sustainable markets) and the incredible recent growth in EBITDA margin despite the drag of 9% of EBITDA margin from the POC tax.

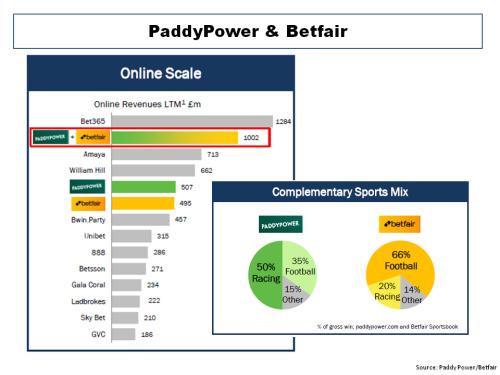

At the most recent results, Corcoran did highlight some headwinds that would bring the margins down (e.g. phasing of marketing spend and increased product investment) but emphasised the “high level of operational gearing” in the business and the “top-line momentum”. The merger of these two high class firms under a proven management team does make one giddy with the possibilities. The brokers Davy have a price target of €129 on the Paddy Power shares (currently trading just below €100). More information should emerge as documents for the shareholder votes are published (closing date expected in Q1 2016). An investor presentation does offer some insight (for example, as per the graphic below).

I have calculated some initial estimates of what the combined entity will look like. Using an assumed constant sterling to euro FX rate of 1.30 and trying to adjust for Betfair’s funny reporting calendar, I estimate calendar year revenue growth 2016 to 2015 at 17% assuming a sterling reporting currency, as per the split below.

I also calculated a profit before tax margin for the combined entity of 18% which increases to 21% post cost savings. Given approx 91 million shares in the new entity, my estimated operating EPS for 2016 is therefore approx £3.85 or approx €5.00 which gives a 20 multiple to operating earnings at the Paddy Power share price around €100 today.

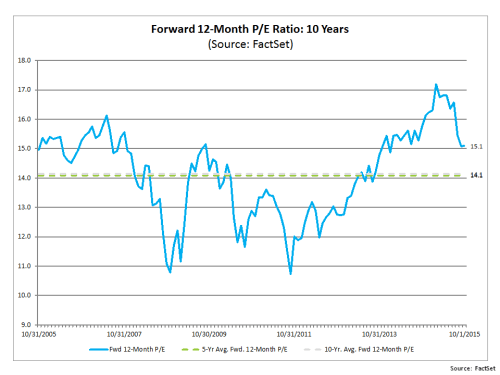

So is buying into the merger of two quality firms with top management in a sector that is undergoing rapid change at a multiple of 20 sensible in today’s market? That depends whether you think it’s time for a gamble or whether patience will provide a more opportune time.