The broker reports on the January renewals paint a picture of building pricing pressures for reinsurers and specialty insurers. The on-going disintermediation in the property catastrophe market by new capital market capacity is causing pricing pressures to spill over into other classes, specifically on other non-proportional risks and on ceding commissions on proportional business.

The Guy Carpenter report highlight that traditional players are fighting back on terms and conditions through “an extension of hours clauses, improved reinstatement provisions and expanded coverage for terror exposures” and “many reinsurers offered more tailored coverage utilizing options such as aggregate and quota share cover, multi-year arrangements and early signing opportunities at reduced pricing”. Guy Carpenter also point to large buyers looking at focusing “their programs on a smaller group of key counter-party relationships that were meaningful in relation to the overall size of the program”.

The Aon Benfield report and the Willis Re report also highlight the softening of terms and conditions to counteract cheap ILS capacity emphasising items such as changes in reinstatement terms. Willis states that “the impact of overcapacity has been most clearly evidenced by the up to 25% risk adjusted rate reductions seen on U.S. Property Catastrophe renewals at 1 January and the more modest but still significant rate reductions of up to 15% on International Property Catastrophe renewals”.

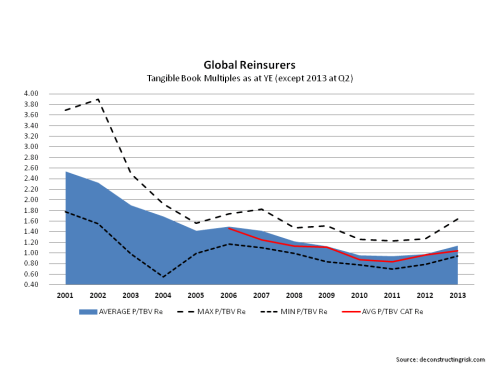

Following an increase in valuation multiples from all time lows for the sector over the past 24 months, the current headwinds for the sector as a result of over-supply and reduced demand mean, in my opinion, that now is a good time for investors to reduce all exposure to the sector and move to the side-lines. I particularly agree with a comment in the Willis report that “experienced reinsurers will remember that the relaxation of terms and conditions more so than price reduction caused the real damage in the last soft market cycle”. Meaningful upside from here just doesn’t look on the cards to me particularly when compared to the downside risks (even M&A activity is likely to be with limited premium and/or on an all stock basis).

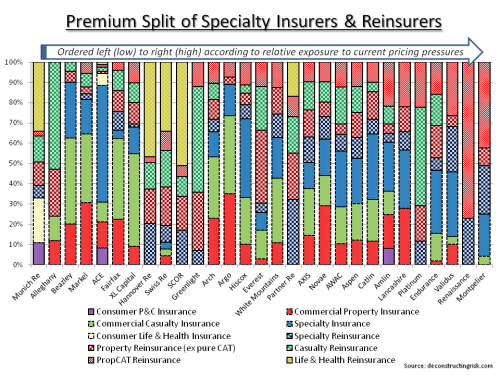

The graph below shows the premium split by main product line for the firms that I monitor. The firms have been sorted left to right (low to high exposure) by a subjective factor based upon exposure to the current pricing pressures. The factor was calculated using a combination of a market pricing reduction factor for each of the main business classes based upon the pricing indicated in the broker reports and upon individual business class discounts for each firm depending upon their geographical diversification and the stickiness of the business written. The analysis is fairly subjective and as many of the firms classify business classes differently the graph should be considered cautiously with a pinch of salt.

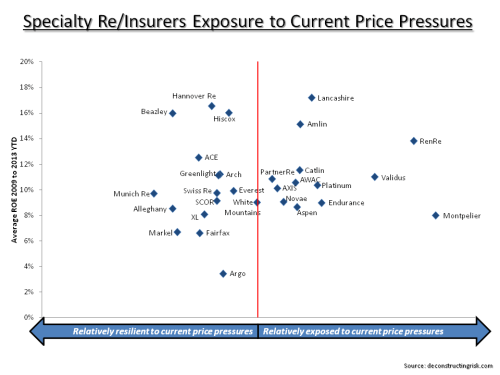

Unsurprisingly, reinsurers with a property catastrophe focus and with limited business class diversification look the most exposed. The impact of the reduced pricing on accident year ratios need to be combined with potential movement in reserves to get the impact on calendar year operating results. Unfortunately, I don’t have the time at the moment to do such an analysis on a firm by firm basis so the graph below simply compares the subjective pricing factor that I calculated against average operation ROEs from 2009 to Q3 2013.

As stated previously, the whole sector is one I would avoid completely at the moment but the graph above suggests that those firms on the right, specifically those in the lower right hand quadrant, are particularly exposed to the on-going pricing pressures.