One of the sectors that I have followed for nearly 15 years now is the emerging telecom sector, specifically the so called altnet or CLEC sector. My affiliation with this sector has been the cause of many highs and lows, some very painful lows, through the telecom/internet bubble & bust, the 2000’s and to this day. Initially the attraction was the boom in internet and data traffic and the leveraged nature of many of the firms. After spectacular gains in the go-go days of the bubble (I bought hook line and sinker into the “picks and shovel” rationale), the subsequent reality of the telecom bust and the “nuclear winter” left me with big losses. For those unfamiliar with the stories of the bubble era, Om Malik’s excellent book “Broadbandits: Inside the $750 bilion Telecom Heist” goes deep into the madness that prevailed.

Over the past 10 years odd, I have had a much more cautious and opportunistic approach on the sector and have had some success at dipping in and out of stocks/debt/options of restructured companies as they moved in and out of favour (particularly prior to the financial crisis). Successes in recent years include the post-bankruptcy Virgin Media and Global Crossing. One notable failure was a firm called XO Communications backed by the vulture investor Carl Icahn. A self publicised champion of the minor investor, when it suits him, investing alongside Icahn in XO proved to be a grave error. This article illustrates some of the drama. I Iearned much from the experience including the dangers of illiquid stocks, the nonsense of following a self hyped dominant “star” investor, and the obvious perils of over-leveraged stocks with poor balance sheets in commoditising businesses. Despite these up and downs, the core thesis of a rapidly increasing data consuming society with the potential for high return/high risk (and often leveraged) investments remains for those with an aggressive risk appetite, particularly now that most of the overcapacity from the telecom boom years is becoming less of a factor. For any investor in this space, Robert Powell’s website Telecom Ramblings is the go-to place to get sensible and experienced insights.

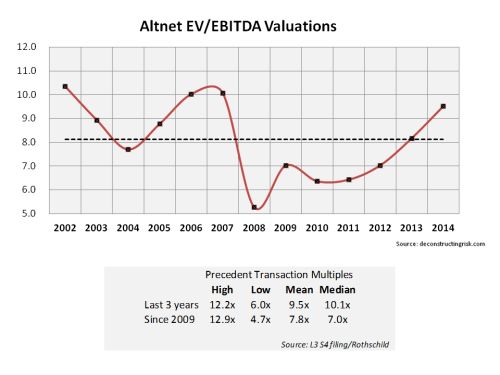

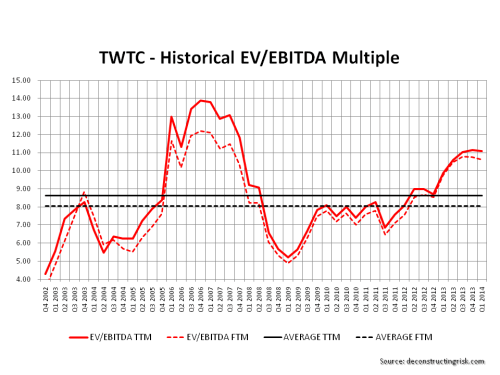

One commonly used valuation metric for telecoms is the EV/EBITDA multiple (although it needs to be supplemented with other metrics such as debt and cash-flow measures to get a holistic picture in the altnet space). The graph below shows the variation that has been prevalent in the sector (for selected firms that survived & there is many names that didn’t).

Historical EV/EBITDA Valuations (point selections as at Year End) click to enlarge

As I was preparing to crystallise my thoughts & analysis on this sector (the discipline of having to write down my analysis for this blog is a big reason I am continuing with this blog experiment), the comments from Keith Meister of Corvex at the Ira Sohn conference this week on Level 3 and TW Telecom have been extremely timely. By the way, Meister is an old colleague of Carl Icahn and served as his envoy on the XO board. Given this pedigree, I would therefore totally discount anything he says as 100% self serving. This post will outline some of the historical experience and a follow-on post will outline my valuation analysis for the future of Level 3 and TW Telecom.

Anybody familiar with this space is well aware of the ups and downs of the soap opera that is Level 3. One of the key players in the telecom boom, it built a wholesale network with the help of vast amounts of equity and debt in the bubble years (raised $14 billion in 1998!) and through the 2000’s became a serial consolidator purchasing firms such as Genuity, Wiltel, Progress Telecom, ICG, Telcove, Looking Glass networks and Broadwing to rebalance its business away from the wholesale business into the enterprise space. It is quite incredible that this company avoided the Chapter 11 route that so many companies in this space had to go through to right-size their balance sheets in the face of the new reality of the sector in the 2000’s. With its merger with the restructured Global Crossing announced in 2011, Level 3 seems to have finally reached a level where its balance sheet fits its business. The company also now has diversity across products and regions which indicate that it may be the right time to focus on organic growth. The arrival of the new CEO, Jeff Storey who previously served as Level 3’s COO and previously was the CEO of Wiltel, and his comments on the latest conference call seem to have signalled that Level 3’s consolidation days are behind it and the focus will now be on driving the company forward given its extensive global assets and improved balance sheet. The company is also a potential attractive takeover target for larger established telecoms looking to expand or from regional telecoms or bandwidth hungry technology companies looking for diversification (the more fanciful speculation highlights Level 3’s chairman Walter Scott & his friendship with Warren Buffet and his place on Berkshire’s Board). Again, Robert Powell posts, such as the one this week on TW Telecom, are the place to go to get sensible and knowledgably views on items such as M&A speculation.

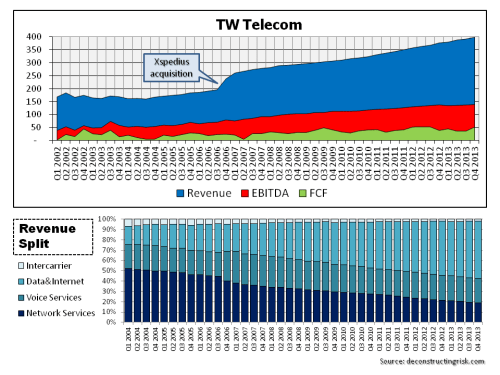

TW Telecom, on the other hand, is at the opposite end of the spectrum to Level 3. It always had a focus on the enterprise space and has such a determined management that its business execution normally results in an ability to predict its quarterly result to the nearest million. Its leverage has always being far more rational than that of Level 3 and it has grown into its balance sheet gracefully over the past years. TW telecom is the sensible stable child to Level 3’s wild rebel in this space. Indeed, TW Telecom’s lack of adventure has been recently cited as a reason why it may be ready for a takeover.

In order to get some context on these two US based firms and a view of what has happened to a European focussed altnet, I also include a historical review of a European company called COLT Telecom (recently cited by Telecom Ramblings as a potential acquisition target for Level 3).

Graph of Historical Share Price for LVLT, TWTC, COLT click to enlarge

The historical operating figures for these three companies are highlighted below.

Historical Level 3 Operating Metrics (US$s) click to enlarge

Historical TW Telecom Operating Metrics (US$s) click to enlarge

Historical COLT Group Operating Metrics (€s) click to enlarge

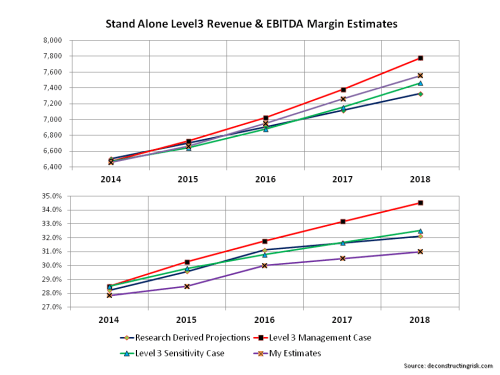

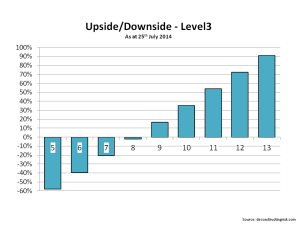

In the interests of open disclosure, I currently own stock & options in Level 3 and have owned some of the other companies named in this post in the past. I am currently re-examining my valuation methodologies for the sector, specifically for estimating Level 3’s future path using TW Telecom as an example of firm’s experience in a relatively steady state and COLT as an example of firm’s experience on a cross border basis. I have used traditional discounted cash-flow and EV/EBITDA multiple analysis in the past but have recently become more sceptical about the underlying theory for such methods. I am trying to adapt them to get a more realistic view of the sector based upon previous experiences. I will post a follow-up of my thoughts and conclusions.