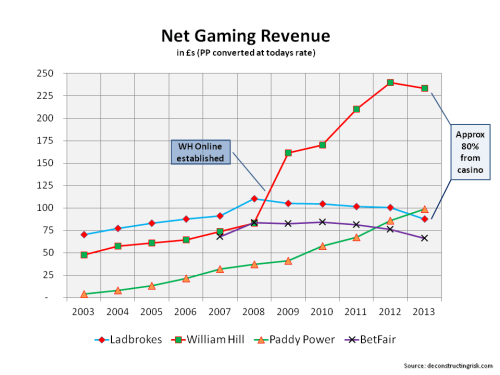

A previous post on Paddy Power, William Hill and Ladbrokes showed how online sportsbook and gaming revenue are becoming an important part of the revenues of these firms. Another recent post on Betfair showed a similar import. This post will focus on the online gaming (which is a gentlier word used in the sector for what is more aptly described as online gambling) part of the equation.

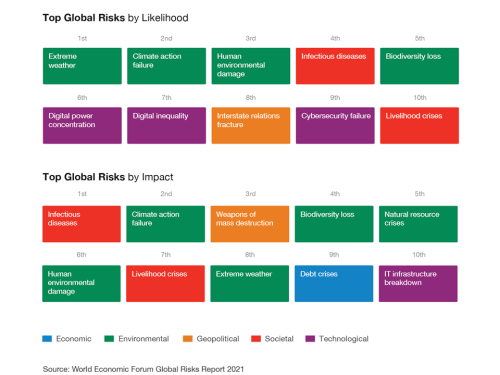

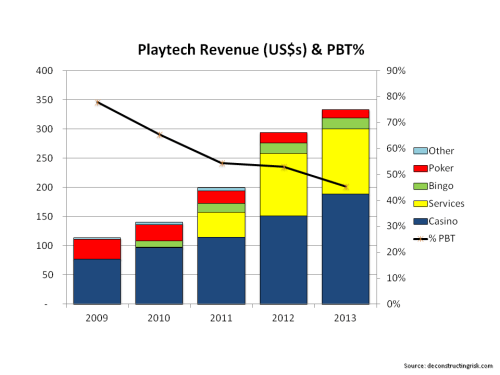

As a recap, the graph below shows the online gaming revenues from Paddy Power, William Hill, Ladbrokes and Betfair (with PP converted to sterling at today’s rate) which make up 17%, 16%, 8% and 17% of their 2013 revenues respectively. Ladbrokes has approximately half the amount of its competitors. The considerable growth in William Hill’s online gaming (mainly casino) revenue after the creation of WH Online (WHO) in 2008 can clearly be seen. H2 Gambling Capital are forecasting an approximate 9% annual growth in online gaming gross win figures over the next few years

click to enlarge

None of the firms above split out their operating margins for the online gaming sectors. As casino is the dominant source of revenue for many of the firms, it is interesting to look at a diminutive online casino firm called 32Red, as per the graph below. Although 32Red is relatively small, the reduction in its margin to an average of 6% suggests that competition has pushed margins down in this business.

click to enlarge

Another two public firms that have a majority of their business in online gaming are 888 and BWIN. 888 is a well established player, particularly in the online casino market, with 40% of revenues in the UK and 40% in the rest of Europe in 2013, and it has been rebuilding its profit margins in recent years. 888’s operating metrics are summarized in the graph below.

click to enlarge

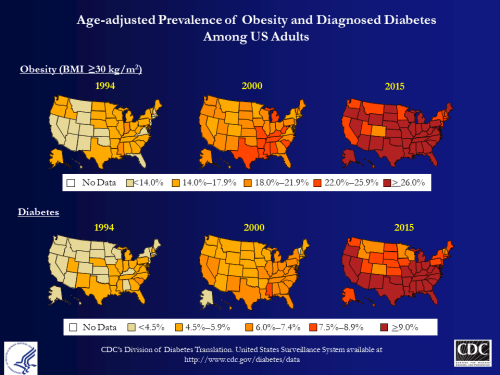

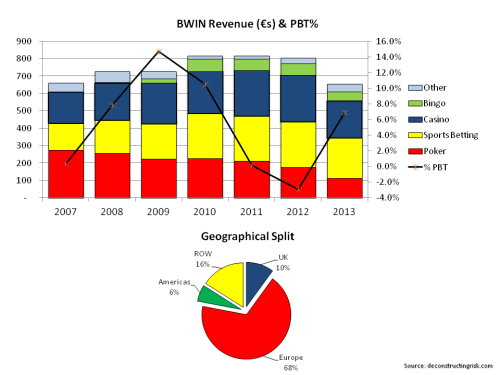

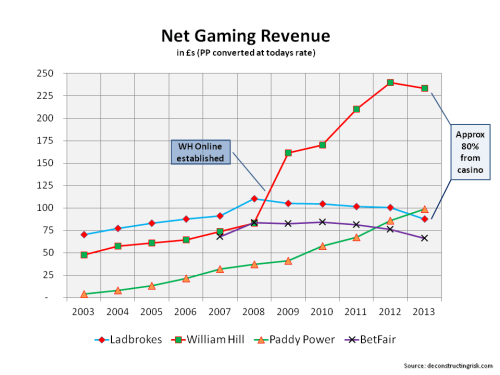

BWIN, following its merger with PartyGaming in 2011, has a higher revenue base across Europe (excluding UK) making up approx 70% of 2013 revenues (25% from Germany) with only 10% from the UK. After some poor results and pressure from shareholders, BWIN is currently cutting its expense base by €30 million or approx 5.5% and is looked at ways it “can increase shareholder value”. BWIN’s operating metrics are summarized in the graph below.

click to enlarge

The share performance of these firms has been distinctly mixed in recent years with little old 32Red blowing the others away, as per the graph below. BWIN has clearly underperformed and may likely be broken up. Analysts have speculated that a number of potential bidders, including William Hill and Paddy Power, are looking at various BWIN assets. Janus Capital Management has being building its stake in BWIN over recent months to 11% as at mid-July.

click to enlarge

Comparing the mainly online gaming firms with their more established betting firms in terms of the PBT margin shows the trend for both is downwards, as per the graph below. Headwinds include increased regulation and taxes such as the proposed UK POC tax. Opportunities include the explosion in mobile gambling, the slow re-opening of the US market (although I am sure established US bricks and mortar gambling firms will fight hard for their turf), new product development such as social gaming and the expected market consolidation. Amaya’s recent purchase of PokerStars has focussed minds on what will be needed to succeed in the US.

click to enlarge

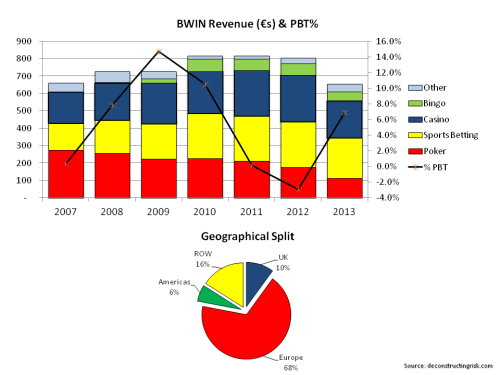

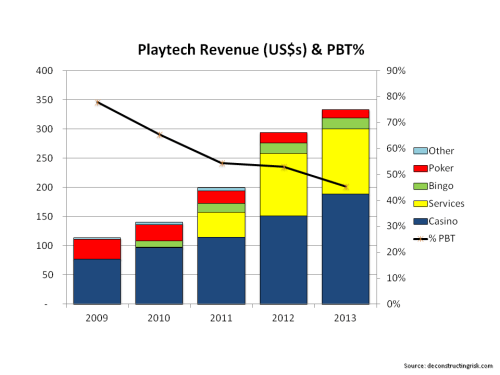

One of the more colourful firms in the sector, Playtech, has some interesting things to say about where the future is leading. On increased regulation, Playtech say that “the regulation of online gambling can be a catalyst for market growth, depending on how regulation is introduced, what product verticals the regulator allows and the tax rate applied” and that ”opportunities exist as markets move from a ‘dot.com’ to a ‘dot.national’ regime, although some uncertainties through the transition period are expected”.

Specifically on the UK, Playtech commented that “many smaller operators are understood to generate operating margins lower than the expected tax rate of 15% and in the view of industry experts, will struggle to compete. Larger operators can rely on economies of scale and their leading brands to remain competitive. Analysts expect that in 2015 the UK market will undergo significant change led by consolidation, as those operators with the strongest brands, best technology and means to invest in marketing will prevail”.

Playtech is a software gaming firm which offers a fully integrated platform across games and sports-betting called IMS that many of the main players use (licensees include Betfair, bet365, William Hill, Paddy Power and Sky, amongst others). They also run a white label turn-key operation called PTTS and a joint venture business. Their most well known joint venture was one where they very successfully partnered with William Hill in 2008 in the creation of William Hill Online (WHO). William Hill recently bought out Playtech of their 29% stake for £424 million. In March 2013, Playtech entered into a deal with Ladbrokes (in an attempt by Ladbrokes to diversify their business and catch up with their competitors – see first paragraph of this post) where, according to Morgan Stanley, Playtech “has effectively been given a quasi-equity stake, where it will “own” 27.5% of any increase in profits”. A Morgan Stanley report, although over a year old, has more interesting background on Playtech (they are still hot on the stock). The graph below highlights some of the metrics behind Playtech.

click to enlarge

Much of the colour behind the firm has been provided by its 40 year old Israeli playboy founder, Teddy Sagi, who has a bribery and insider trading conviction from his youth in the 1990s. Playtech bought many of the assets used in the WHO 2008 deal from Sagi and also the PTTS assets (70% of this business is from Imperial e-Club licensed in Antigua and Barbuda!) in 2011 which caused concerns about conflicts of interest. Concern over such conflicts on what Playtech may do with its new cash pile from the WHO sale (they returned £100 million in a special dividend earlier this year but still have £376 million in cash as at end Q1) and on potential problems that Sagi’s ownership position may do in gaining access to the US resulted in an offering in March this year which reduced his 49% stake to 34%.

Playtech has stated that their “the Board is seeking transformational M&A opportunities to take the business to the next level.” Although it’s a bit too colourful for me, a number of analysts estimate a 20%+ upside on its current share price and it’s interesting to note that David Einhorn’s Greenlight Capital is a believer with an ownership of 3.8%. That, I think, is a good place to end a post on gambling!