As we approach the July renewals, new capacity continues to pour into the insurance linked securities space pushing prices ever downward. Morgan Stanley estimate that so called alternative capital will make up 30% of the forthcoming July renewal. Market participants continue to cheer on the arrival of this capacity. To counter some of the concerns expressed about this market, some of which were outlined in my last post on this subject, I noticed an interesting article this week from Guy Carpenter’s website.

The article starts with an overview of the market stating “the impact has been dramatic; pricing has decreased more than 50 percent year over year, particularly for peak U.S. risks such as Florida”. And continues “the institutional money that is offering capacity to Florida wind at 40 percent less than last year’s pricing isn’t pricing Florida risk incorrectly, it just does not have the same capital costs and therefore can, on a sound basis, charge less for peak U.S. wind risk than the traditional reinsurance market on a sustained basis.”

In other words, the return hurdles for institutional money is less! That doesn’t make sense if you consider the reduced diversification offered by investments in property catastrophe focused funds to institutional money compared to traditional reinsurers which have diversified portfolios spread over property, casualty, specialty and, in some cases, life business.

Guy Carpenter continue in their attempt to convince themselves that everything will be okay by stating that “increasing the breadth of an informed sophisticated investor base can only be a good thing for the markets’ long term prospects as it increases available capacity without leaving the market susceptible to reckless capital that will support transactions with ill-considered terms, which eventually cause problems themselves or set problematic precedents for others to follow.”

I don’t really understand what they are saying here. Is it something as hollow as it’s okay to slash prices as they are “sophisticated investors”? I have even heard another broker try to justify the overall market benefit of the influx of capacity by concluding that excess capacity will result in more policyholders in the high risk zones being able to get property cover. I didn’t know that the institutional investors are getting into this asset class with the intent that the risk profiles expand! Where have we heard that before?

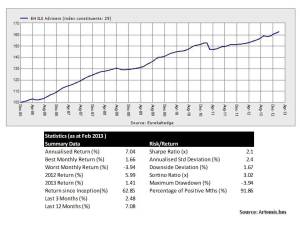

The article again states that “capacity is expanding because sophistication and attention to transaction mechanics is increasing, not decreasing.” Let’s look at a recent deal to see how that statement stacks up. One recent deal this month by Travelers, under the Long Point Re series, covering northeast US wind was priced as per the graphic below compared to last year.

Looking at a crude measure of risk and reward, as the coupon divided by expected loss, shows a ratio reduction from 741% to 345% for 2012 to 2013. Other recent deals also show reductions in the risk/reward dynamics such as the Turkish quake deal, under the Bosphorus Re banner, which got away for 250 basis points compared to an expected loss cost of 1% (that’s a 250% ratio). Industry veteran, Luca Albertini of ILS fund Leadenhall Capital Partners, remarked that the Turkish deal was significant as previously this market did not like to play in the sub-300 basis points deal area. Albertini put a positive spin on this development for his sector by saying that the new appetite for sub-300bps issuances means that a wider range of exposures and therefore deals can be marketed, thereby providing diversification. That sounds great but, to paraphrase a quote from Jim Leitner, is there any real benefit to diversification if such diversification comes from a portfolio of underpriced assets? Underpriced risk is, after all, mispriced risk.

I recently asked a banker, who has marketed this new asset class to clients, at what level of return would the institutional investors walk away. To my surprise he said none; based upon his previous experience of investors following sheep like into quant driven new “non-correlating” asset classes, only a loss would awaken investors to the risks. It’s depressing to think that institutional money still likes to partake in the practice of picking up pennies in front of a stream roller!

As readers will realise, I am becoming ever more cautious on the wholesale insurance & reinsurance sector. With overall demand decreasing and supply increasing, the sector looks like it’s reaching an inflection point. In the short term, returns will likely remain acceptable (high single/low double digit ROE) if claim inflation stays mute resulting in continuing underwriting profits/reserve releases and in the absence of large catastrophes. In the medium term, ILS pricing pressures and new capacity entering the traditional market (latest examples include new money from Qatar in the form of Q Re and the AON/Berkshire deal providing a 7.5% blind follow line across the Lloyds market) leads me to conclude that a more defensive investment strategy in this space is warranted.