I have been neglecting this blog as the soap opera that is American politics has been playing out. Trump’s decision to go for it full throttle straight from the off looks like resulting in political war in the US which will no doubt result in a messy few weeks, if not months, ahead. The jury is still out on whether this new form of extreme politics can survive indefinitely, or whether one of Trump’s skeletons will come crashing out of the closet, or whether Trump gets catch out dealing with an unexpected event. For the Democrats, there is the depressing thought that if Trump messes up big time, the option of impeachment requiring their consent to a two third majority in congress, would only result in President Pence!

My instinct is telling me to reduce equity exposure currently, on valuation concerns rather than political ones, and my hard fought for risk management discipline means I am acting on that instinct. I also distrust the neatness of the market consensus that markets will rise on stimulus hopes to mid year before falling back to sustainable valuations by year end. Reality is never neat, especially I suspect in Mr Trumpland. Notwithstanding this environment, one of my new year’s resolutions was to try and get some new equity ideas to track and maybe pick up if valuations get more attractive.

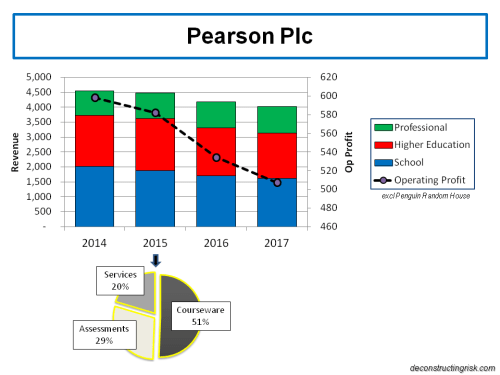

The disappointing results from Pearson Plc two weeks ago reminded me of my last post on the technological changes disrupting the education sector. I thought I would have a quick look over some of the firms mentioned in that post three years on. The trends at Pearson are not pretty, as the graph below shows. Particular poor results in the US higher education sector mean the firm is selling off Penguin Random House and “taking more radical action to accelerate our shift to digital models and to keep reshaping our business”. Pearson’s stock is down over 50% since my last post three years ago and another shakeup in management, if not strategy, looks inevitable.

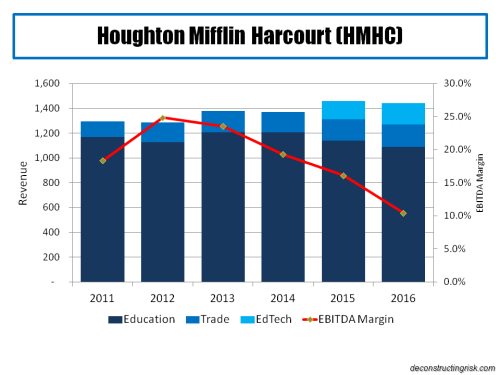

In fact the hope that the juicy margins of the old world text book business can be transferred to the new on-line world is looking fanciful. The shift to on-line education looks like another example of technology gutting the margins of yesteryear’s reliable business models. Houghton Mifflin Harcourt (HMHC) has a younger school focus and was the main education stock featured in my 2014 post. HMHC too is down considerably over the past three years, approx 42%. The graph below shows the downward trend in its core revenues and margins.

So it looks like hoping established education firms can transition with seamless profits into the digital world is not a place to look for new investment ideas. Of course, there have been big successes in the online sphere from newer firms and business models. TAL Education (ticker TAL), the Chinese K12 after school online tutor, is one and it’s up approx 250% over the past three years. It’s outside of my risk appetite as I prefer large diverse established firms with a clear market advantage, an understandable reason for upside and a management team I can believe in to entrust my optimism.

The search for new ideas goes on…

PS – Any ideas out there would be greatly welcome!