In my last post on AIG, I expressed my doubts about the P&C targets outlined in their plan. After first announcing a $20 billion retroactive reinsurance deal with Berkshire covering long tail commercial P&C reserves for accident years prior to 2015 in January, AIG just announced another large commercial lines reserve charge of $5.6 billion principally from their US business. The graph below shows the impact upon their 2016 pre-tax operating income.

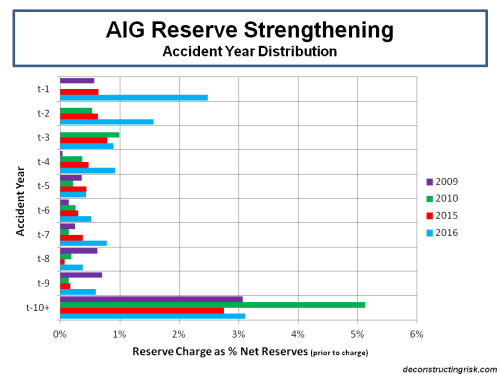

The latest reserve hit amounts to 12% of net commercial reserves at end Q3 2016 and compares to 7%, 8% and 6% for previous 2015, 2010, and 2009 commercial reserve charges. Whereas previously reserve strengthening related primarily to excess casualty and workers compensation (WC) business (plus an asbestos charge in 2010), this charge also covers primary casualty and WC business. The accident year vintage of the releases is also worryingly immature, as the graph below shows. After the 2016 charge, AIG have approx $7 billion of cover left on the Berkshire coverage.

Although AIG have yet again made adjustments to business classifications, the graph below shows near enough the development of the accident year loss ratios on the commercial book over recent times.

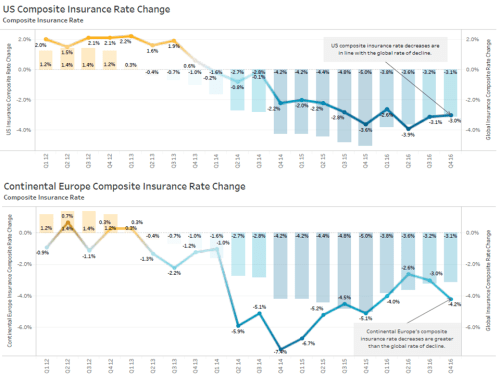

It is understandable that AIG missed their aggressive target against the pricing background of the past few years as illustrated by the latest Marsh report, as the exhibits below on global commercial rates and the US and European subsets show.

All of these factors would make me very skeptical on the targeted 62% exit run rate for the 2017 accident year loss ratio on the commercial book. And no big reinsurance deal with Berkshire (or with Swiss Re for that matter) or $5 billion of share buybacks (AIG shares outstanding is down nearly a third since the beginning of 2014 due to buybacks whilst the share price is up roughly 25% over that period), can impact the reality which AIG has now to achieve. No small ask.

Some may argue that AIG have kitchen-sinked the reserves to make the target of accident year loss ratios in the low 60’s more achievable. I hope for the firm’s sake that turns out to be true (against the odds). The alternative may be more disposals of profitable (life) businesses, possibly eventually leading to a sale of the rump and maybe the disappearance of AIG altogether.