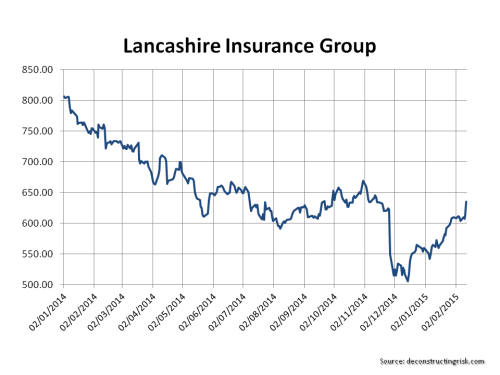

With exposure adjusted rates in the specialty insurance and reinsurance sector continually under pressure and founder/former CEO, Richard Brindle, making an unseemly quick exit with a generous pay-out, Lancashire’s stock has been decidedly unloved with the price trading well below the key £7 threshold highlighted in my last post on the subject in February. Although we remain in the middle of the US hurricane season (and indeed the Napa earthquake is a reminder that its always earthquake season), I thought it was a good time to have a quick look over Lancashire’s figures again, particularly as the share price broke below the £6 threshold earlier this month, a level not seen since early 2011. The stock has clearly now lost its premium valuation compared to others in the London market as the graph below shows.

click to enlarge

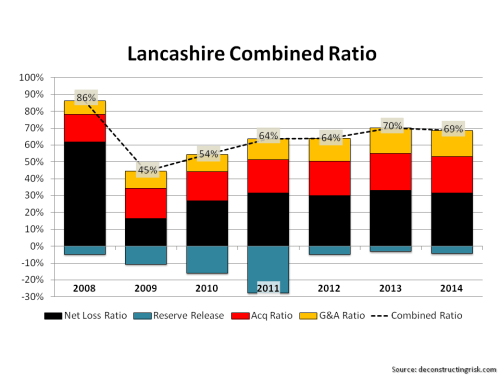

Results for H1-2014, which include full numbers from the November 2013 acquisition of Cathedral, show a continuing trend on the impact of rate reductions on loss ratios, as per the graph below.

click to enlarge

The impact of the Cathedral deal on reserve levels are highlighted below. The graph illustrates the consistent relative level of IBNR to case reserves compared to the recent past which suggests a limited potential for any cushion for loss ratios from prior year reserve releases.

click to enlarge

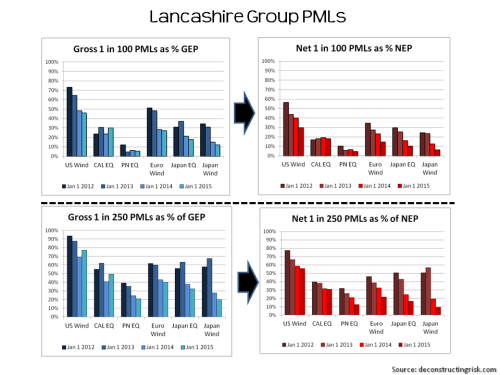

The management at Lancashire have clearly stated their strategy of maintaining their discipline whilst taking advantage of arbitrage opportunities “that allow us to maintain our core insurance and reinsurance portfolios, whilst significantly reducing net exposures and enhancing risk adjusted returns”. In my last post, I looked at post Cathedral gross and net PMLs as a percentage of earned premiums against historical PMLs. More applicable figures as per July for each year, against calendar year gross and net earned premiums (with an estimate for 2014), are presented below. They clearly show that the net exposures have reduced from the 2012 peak. It is important to note however that the Gulf of Mexico net 1 in 100 figures are high at 35%, particularly compared to many of its peers.

click to enlarge

There is of course always the allure of the special dividend. Lancashire has indicated that in the absence of attractive business opportunities they will look at returning most, if not all, of their 2014 earnings to shareholders. Assuming the remainder of 2014 is relatively catastrophe free; Lancashire is on track to make $1-$1.10 of EPS for the full year. If they do return, say, $1 to shareholders that represents a return of just below 10% on today’s share price of £6.18. Not bad in today’s environment! There may be a short term trade there in October after the hurricane season to take advantage of a share pick-up in advance of any special dividend.

Others in the sector are also holding out the prospect of special dividends to reward patient shareholders. The fact that other firms, some with more diverse businesses and less risky risk profiles, offer potential upside through special dividends may also explain why Lancashire has lost its premium tangible book multiple, as per the first graph in this post.

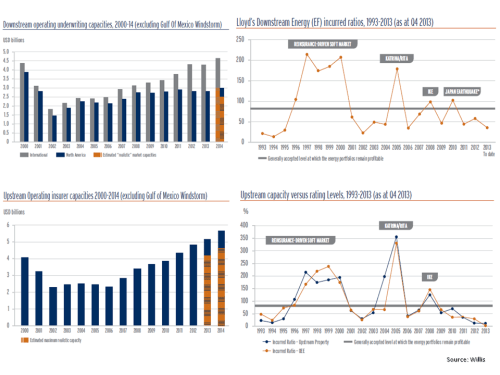

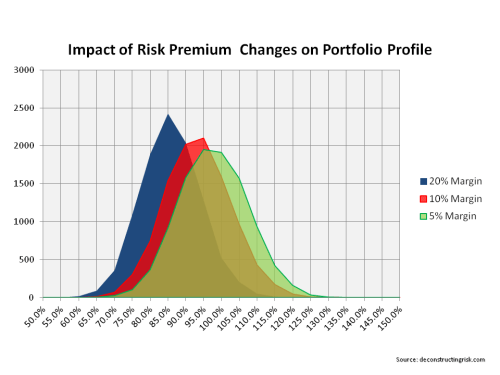

Notwithstanding that previously Lancashire was a favorite of mine due to its nimble and focused approach, I cannot get past the fact that the sector as a whole is mired in an inadequate risk adjusted premia environment (the impact of which I highlighted in a previous post). In the absence of any sector wide catalyst to change the current market dynamic, my opinion is that it is expedient to pass on Lancashire here, even at this multi-year low.

The game of chicken that is unfolding across this sector is best viewed from the side-lines in my view.