Edward Noonan of Validus is always good copy and the Q1 conference call for Validus provided some insight into the market ahead of the important July 1 renewals. When asked by an analyst whether the catastrophe market was reaching a floor, Noonan answered that “I’m starting to think we might be heading for the basement”.

He also said “I think the truly disruptive factor in the market right now is ILS money. I made a comment that we’ve always viewed the ILS manager business behaving rationally. I can’t honestly say that (anymore with) what we’re seeing in Florida right now. I mean we have large ILS managers who are simply saying – whatever they quote we will put out a multi-hundred million dollar line at 10% less.”

I have posted many times on the impact of new capital in the ILS market, more recently on the assertion that ILS funds havw a lower cost of capital. Noonan now questions whether investors in the ILS space really understand the expected loss cost as well as experienced traditional players. Getting a yield of 5% or lower now compared to 9% a few short years ago for BBB – risks is highlighted as an indication that investors lack a basic understanding of what they are buying. The growing trend of including terrorism risks in catastrophe programmes is also highlighted as a sign that the new market players are mispricing risk and lack basic understanding on issues such as a potential clash in loss definitions and wordings.

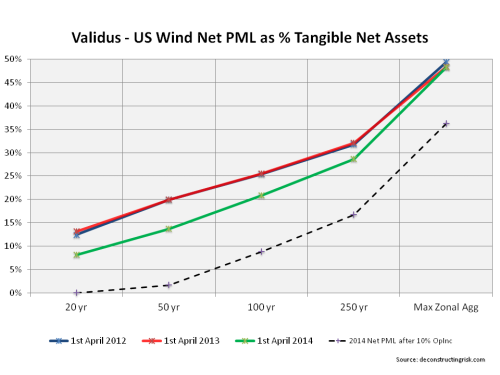

Validus highlight how they are disciplined in not renewing underpriced risk and arbitraging the market by purchasing large amounts of collaterised reinsurance and retrocession. They point to the reduction in their net risk profile by way of their declining PMLs, as the graph below of their net US wind PMLs as a percentage of net tangible assets illustrates.

This is positive provided the margins on their core portfolio don’t decrease faster than the arbitrage. For example, Validus made underwriting income in 2012 and 2013 of 6% and 17% of their respective year-end net tangible assets. The graph below also shows what the US Wind PML would be reduced by if an operating profit of 12% (my approximation of a significant loss free 2014 for Validus) could be used to offset the US Wind net losses. Continuing pricing reductions in the market could easily make a 12% operating profit look fanciful.

I think that firms such as Validus are playing this market rationally and in the only way you can without withdrawing from core (albeit increasingly under-priced) markets. If risk is continually under-priced over the next 12 to 24 months, questions arise about the sustainability of many existing business models. You can outrun a train moving out of a station but eventually you run out of platform!