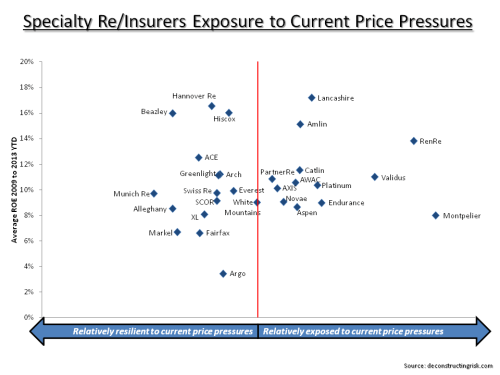

I was talking to an analyst last week about the returns on equity in the traditional reinsurer/specialty insurer market versus that in the ILS market. I have posted recently on the mid single digit returns currently on offer from (unlevered) ILS funds and also on the ROEs in the “traditional” market.

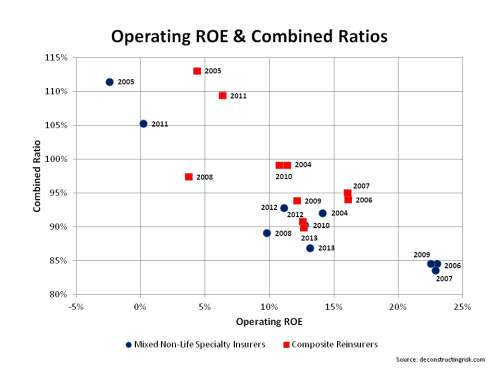

We couldn’t agree on what the historical ROE from the traditional market going back 20 years was so I decided to have a look at some figures. The graph below represents a simple average of a sample of firms going back to 1995. I selected a simple average rather than a weighted average as it should be a good representation of the varying business models and used operating ROEs where possible to reflect underwriting results. The number of firms in the 1990s in the sample is relatively small compared to the 2000s as many of the current firms were not around in their current form in the 1990s.

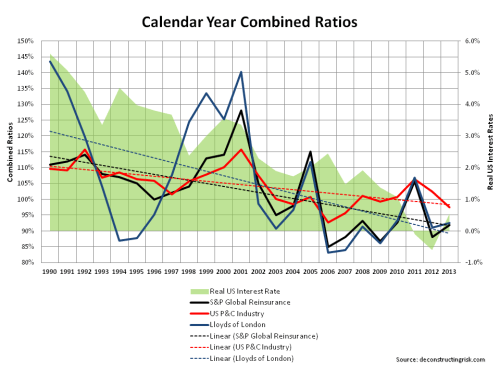

The interesting outcome is that since 1995 the average (of the average annual operating) ROE is 10% with the 10 year average increasing from around 8%-9% to 11%-12% more recently. The volatility is obviously a function of the underlying risk (the standard deviation is 6%) although it is interesting that the recent high losses of 2005 and 2011 were not enough to push the average ROEs into negative territory. That illustrates the importance of differing business models in the sector.

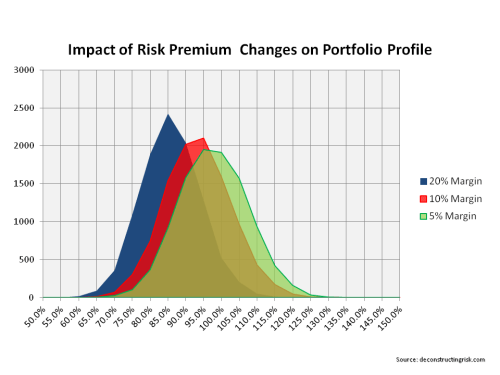

Given the depressed level of risk premia across financial markets, it’s understandable that the capital markets have been attracted by a sector with an average ROE of 10%. Of course, the influx of new capital is making the average ever more unattainable. KBW are the latest market commentator who has called the relaxation of terms and conditions in reinsurance as a result of the softening market as “dangerous”. As the old underwriting adage goes – “don’t let the smell of the premium distract you from the stink of the risk”.