Valuations remain high (S&P PE at 19.5 and CAPE over 25) despite recent volatility and I have posted on my views previously. A recent post on Level3 (LVLT) in December referred to increases in telecom valuation multiples. Since then LVLT reported a very good end to the year and has rocketed to around $38, or an approx 9.4 EV to 2014 guided EBITDA multiple (and 8.7 to my 2015 estimated EBITDA). An analyst report, whilst upgrading the stock, commented “with a focus that has shifted from a slow deleveraging exercise via acquisitions to now focusing on integration and execution of assets the company possesses, we believe we are on the cusp of a sustained outperformance”. Although I generally ignore anything analysts say, I too am bullish on LVLT over the longer term based upon the virtuous circle of improving operating results and decreasing debt. However I think valuation may have gotten ahead of itself with LVLT up 70% in 6 months. I have taken some profits to buy some downside protection. There is likely to be some bumps on the road in 2014 both for companies like LVLT and from an overall market viewpoint. Structural changes in the rapidly changing telecom market like net neutrality or the proposed Comcast/Time Warner Cable (TWC) merger may also have an impact.

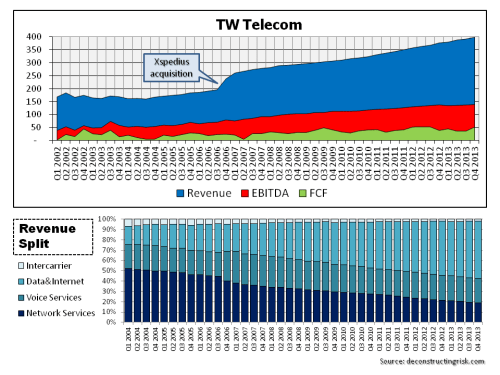

Speaking of Time Warner, there is a telecom that was spun off from Time Warner in the late 1990s called TW Telecom (TWTC) that has a history over the past 10 years of outstanding execution. Over that time, TWTC has diversified itself away from its roots (top 10 customers make up 18% of revenues in 2013 compared to 23% 5 years ago and 40% 10 years ago) with a current focus on business Ethernet, data networking, IP VPN, Internet access, and network security services for enterprises. The graphic below illustrates how successful and consistent TWTC’s operating results has been. I would particularly highlight their results through the troubled 2007 to 2009 period. TWTC have had solid 35% EBITDA margins for the past 10 years with average capital expenditures of 25% as they build their last mile metro fiber network to their business customers on a success basis. Their execution is in no small measure down to one of the best (and most consistent) management teams in the business, led by long term CEO Larissa Herda.

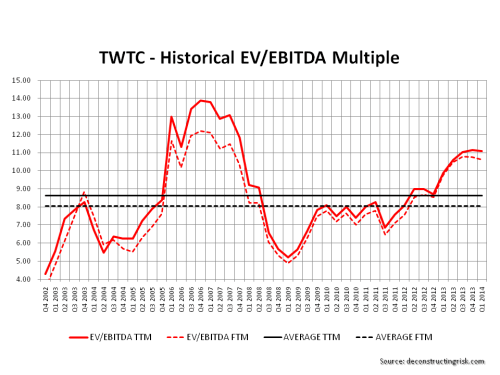

In addition to solid operating results, TWTC have always shown disciplined balance sheet management with net debt well below 2 times EBITDA in the past 5 years (except for 2013 at 2.3 times as per the changes below). As a result of the factors highlighted above, TWTC has always enjoyed a premium valuation multiple in the market as the graph (of enterprise value to twelve month trailing (TTM) and future twelve months (FTM) EBITDA) below shows.

TWTC has long been talked of as an acquirer or a target for others but nothing of substance has materialised since their Xspedius acquisition back in 2006. The firm has increasingly undertaken shareholder friendly actions such as the $400 million spend on its own shares in 2013. TWTC has also bought back convertible debt and pushed out the maturities on its debt which has increased from YE2012 of $1.76 billion to just below $2 billion as at YE2013.

The reason for the increase in debt plus an additional one-off capital expenditure of $120 million in 2013 on capital leases (not included in graph above), with another one off $50 million due in 2014, is a strategic market expansion announced by TWTC in late 2013. The strategic market expansion is to extend its metro fiber footprint into 5 new high demand markets and accelerate the density of its metro-fiber footprint in 27 existing markets by 17%. Given TWTC’s history of execution, their plans for expansion and the (almost giddish) optimism of management during their Q4 conference call caught my attention. These are people who have not make such promises lightly in the past.

One of the factors behind their expansion is the success of new product innovation introduced in 2012, namely products called Enhanced Management and Dynamic Capacity. Such products allow enterprises to automate, manage and purchase network capacity on a flexible real time framework based upon their needs and offer flexibility in accessing connections to private, hybrid and public clouds. TWTC refer to their state of the art network as the Intelligent Network and are marketing their range of products on the basis of what they call their Constellation Platform which “will connect our customers nearly instantaneously through data centers directly to numerous applications in the cloud with increasing network automation”. All of these fancy products names and high minded assertions shouldn’t in themselves be taken as anything earth shattering in the rapidly changing IT and telecom market. What may be special is that TWTC has indicated increased interest in their offerings and that, through partnerships with cloud providers such as Amazon, they are getting interest from new enterprises with big data needs . TWTC state that their expansion is “a very targeted opportunity to rapidly increase our market density to drive additional revenue growth and greater cash flow” and that it “is all part of our broader vision of bringing better, faster and easier solutions to customers as we continue to innovate and create market differentiation”.

Given the history of execution by TWTC’s management, I would be positive on their ability to deliver on their promises. They have indicated that EBITDA margins will be under pressure in 2014 as they staff up for the new expansion. For 2015 & 2016, EBITDA expansion of 10% to 15% does not seem unreasonable to me based upon my calculations. Given a current EV/EBITDA on a TTM basis of over 11, TWTC is not cheap and, as stated in the beginning of this post, there are likely to be bumps in the road over 2014. Such bumps may provide an opportunity to back TWTC and its expansion at an attractive valuation.

I, for one, will be looking out for it.