As we face the peak weeks of the COVID19 virus in the major developed economies, one thing the current COVID19 outbreak should teach us is humility. As humans, we have become far too arrogant about our ability to shape the future. A new book by the economists John Kay and Mervyn King (a former Bank of England governor during the financial crisis) called “ Radical Uncertainty” argues that economists have forgotten the distinction between risk and uncertainty with an over-reliance on using numerical probabilities attached to possible outcomes as a substitute for admitting there are uncertainties we cannot know. How many one in a century events seem to be happening on a regular basis now? Their solution is to build more resilient systems and strategies to confront unpredictable events. Such an approach would have a profound impact on how we organise our societies and economies.

Currently, planning for events with a large impact multiplied by a small probability allows us to effectively continue as we have been after assigning the minimal amount of contingency. Imagine if sectors and industries were run based on been prepared for tail events. That would be a radical change. Very different from our just in time supply chains which minimise capital allocation and maximise return on investment. Our approach to climate change is an obvious case in point and how we have heretofore ignored the environmental externalities of our societies and economies. Given the financial costs this crisis is going to place on future generations, I would suspect that the needs of this cohort of our society will become ever more urgent in the aftermath of the COVID19 pandemic.

As many people grapple with the current uncertainties presented by this pandemic, we are currently at peak uncertainty in Europe and the US. We are only now getting a sense of how the outbreak is peaking in Europe given the lock down measures in place. How the virus reactions to the relaxation of current measures, how the outbreak will peak across the US and other continents, the economic impact of the outbreak, or the societal impact amongst many other issues are as yet unknown. We do know however that with time over the coming weeks some of these answers will become clearer. For example, as the graph below from the FT shows, we known the approximate path of the outbreak given the policies being pursued today.

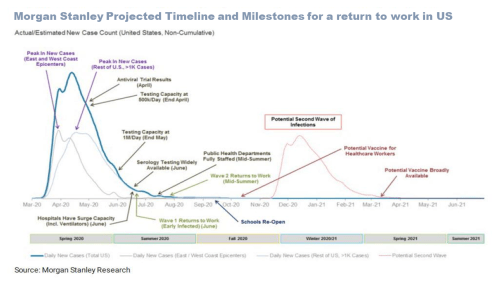

A positive narrative could be that existing medications pass rushed COVID19 trials and prove they can blunt the impact of the virus thereby altering the shape of the curve. We can also speculate that once the first wave is contained, we will develop strategies on a combination of mitigation measures (e.g. reduced isolation methods, antibody and other testing to return sections of the population to work, immunity passports, etc) to slowly transition to the new normal. The logistics of such a phased return to normal will be complex and a nightmare to enforce, particularly if self-isolation measures are in force for lengthy periods and people believe any second wave can be well contained by battle hardened health systems. We can be confident that a vaccine will be developed, hopefully by early 2021, but it will take time to get the vaccine distributed and administered in bulk. Mid 2021 is likely the best we can realistically hope for.

At this stage, my rough guess at a base case scenario on the timing for European and US lockdown is 3 to 5 weeks with another 6 to 10 weeks to transition to a semi-new normal. That’s somewhere between mid-June and early August with Europe leading the way followed by the US. A more pessimistic case could be that discipline amongst the population gets more lax as the weeks drag on and a second wave gathers momentum with a second lockdown required over the summer followed by a more timid and gradual transition afterwards lasting until the end of the year. Obviously, these timings are pure guesses at this time and may, and hopefully will, prove way off base.

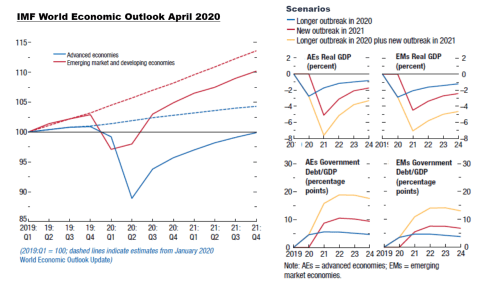

The economic impacts are highly uncertain but will become clearer as the weeks pass. For example, with just the first fiscal stimulus package passed in the US, the politicians are already listing their priorities for the second (and likely not to be the last either), Morgan Stanley expect the cyclically adjusted primary fiscal deficit to rise to 14% of GDP and the headline fiscal deficit at 18% of GDP in 2020, as per their graphic below. Given the unknown impact of the crisis on GDP numbers, these percentages could approach 15% to 20% with total debt of 110% to 120%. It’s depressing to note that prior to this crisis the IMF said the U.S. debt-to-GDP was already on an unsustainable path.

Although the euro zone comes into the crisis with less debt, last year it was 86% of GDP, Jefferies said in a ‘worse case’ outcome where nominal GDP falls 15% this year, the bloc’s budget gap would balloon to 17% of GDP from just 0.8% last year. They estimate in this scenario that the euro zone debt-GDP ratio could rise above 100% in 2021. As a percentage of GDP, Morgan Stanley estimated the G4+China cyclically adjusted primary deficit could rise to 8.5% of GDP in 2020, significantly higher than the 6.5% in 2009 immediately after the global financial crisis. Unemployment rates in the short term are projected to be mind boggling horrible at 20%+ in some countries. It seems to me that the austerity policies pursued after the financial crisis will not be as obvious an answer to repayment of this debt, not if we want western societies to survive. Addressing generational and structural income inequalities will have to be part of the solution. Hopefully, an acceleration of nationalism wouldn’t.

On the monetary side, the Fed’s balance sheet is now estimated to be an unprecedented $6 trillion, an increase of $1.6 trillion since the start of the Fed’s unprecedented bailout on the 13th of March. Bank of America estimates it could reach $9 trillion or 40% of GDP, as per the graphs below.

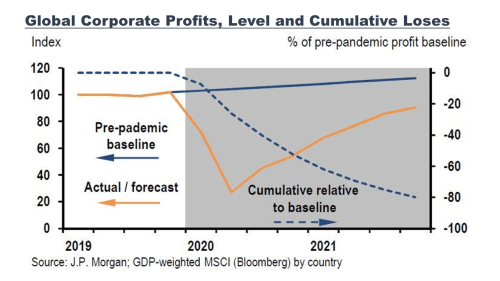

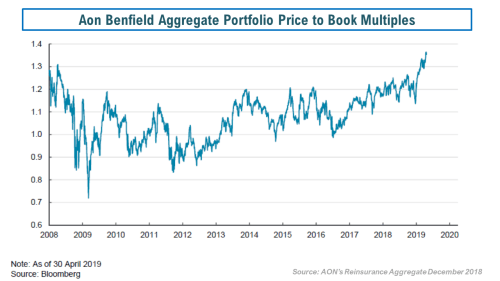

As to corporates and the stock market, dividends will undoubtably be under pressure as corporate delevering takes hold and without the crack cocaine of the bull market, share buybacks as the graph below shows, I fear there will be more pressure on valuations. The Q1 results season and forward guidance (or lack thereof), although it may have some surprises from certain firms in the communication, technology and consumer staples space, will likely only compound the negativity and uncertainty.

Using unscientific guesses on my part, I have estimated base and pessimistic operating EPS figures for the S&P500 as below. Based upon a forward PE (on a GAAP EPS) of 15 (approx. 12.75 on operating EPS basis), which is the level reached after the dot com bubble and the financial crisis, the resulting level for the S&P500 is 2,000 and 1,600 in the base and pessimistic scenarios respectively. That’s a further 20% and 35% drop from today’s levels respectively.

The coming weeks will likely be horrible in terms of human suffering and death across the developed world (one cannot even comprehend the potential suffering in the developing world if this insidious virus takes hold there). There is always hope and uncertainty will reduce over time. Major decisions will need to be made in the months and years ahead on the future of our societies. Learning from this pandemic to build more resilient societies and economies will be a task that lasts many years, possibility even generations. Major changes are coming after this health crisis subsides, hopefully they will be for the better.

Stay safe.